Page 61 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 61

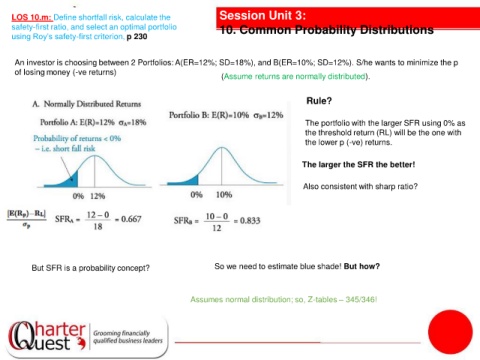

LOS 10.m: Define shortfall risk, calculate the Session Unit 3:

safety-first ratio, and select an optimal portfolio 10. Common Probability Distributions

using Roy’s safety-first criterion, p 230

An investor is choosing between 2 Portfolios: A(ER=12%; SD=18%), and B(ER=10%; SD=12%). S/he wants to minimize the p

of losing money (-ve returns)

(Assume returns are normally distributed).

Rule?

The portfolio with the larger SFR using 0% as

the threshold return (RL) will be the one with

the lower p (-ve) returns.

The larger the SFR the better!

Also consistent with sharp ratio?

But SFR is a probability concept? So we need to estimate blue shade! But how?

Assumes normal distribution; so, Z-tables – 345/346!