Page 66 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 66

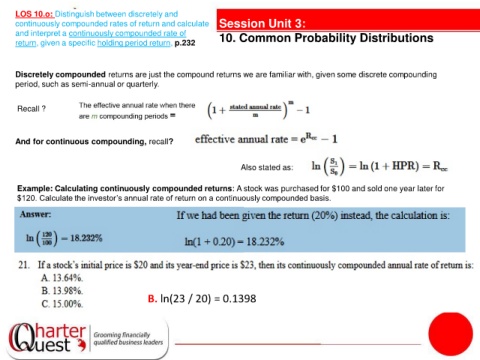

LOS 10.o: Distinguish between discretely and

continuously compounded rates of return and calculate Session Unit 3:

and interpret a continuously compounded rate of 10. Common Probability Distributions

return, given a specific holding period return, p.232

Discretely compounded returns are just the compound returns we are familiar with, given some discrete compounding

period, such as semi-annual or quarterly.

Recall ?

And for continuous compounding, recall?

Also stated as:

Example: Calculating continuously compounded returns: A stock was purchased for $100 and sold one year later for

$120. Calculate the investor’s annual rate of return on a continuously compounded basis.

B. ln(23 / 20) = 0.1398