Page 14 - F6 - Capital Allowances - Part 3

P. 14

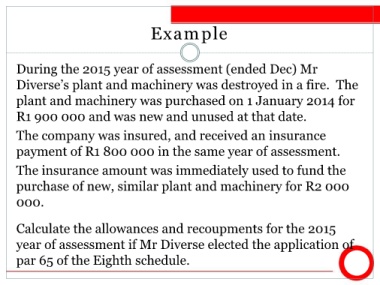

Example

During the 2015 year of assessment (ended Dec) Mr

Diverse’s plant and machinery was destroyed in a fire. The

plant and machinery was purchased on 1 January 2014 for

R1 900 000 and was new and unused at that date.

The company was insured, and received an insurance

payment of R1 800 000 in the same year of assessment.

The insurance amount was immediately used to fund the

purchase of new, similar plant and machinery for R2 000

000.

Calculate the allowances and recoupments for the 2015

year of assessment if Mr Diverse elected the application of

par 65 of the Eighth schedule.