Page 18 - F6 - Capital Allowances - Part 3

P. 18

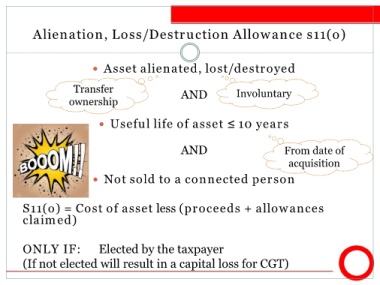

Alienation, Loss/Destruction Allowance s11(o)

Asset alienated, lost/destroyed

Transfer AND Involuntary

ownership

Useful life of asset ≤ 10 years

AND From date of

acquisition

Not sold to a connected person

S11(o) = Cost of asset less (proceeds + allowances

claimed)

ONLY IF: Elected by the taxpayer

(If not elected will result in a capital loss for CGT)