Page 13 - PowerPoint Presentation

P. 13

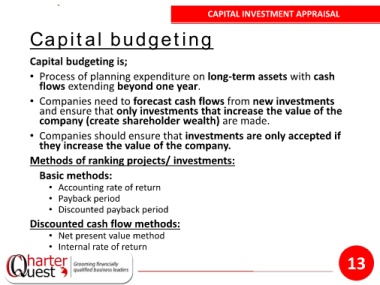

CAPITAL INVESTMENT APPRAISAL

Capital budgeting

Capital budgeting is;

• Process of planning expenditure on long-term assets with cash

flows extending beyond one year.

• Companies need to forecast cash flows from new investments

and ensure that only investments that increase the value of the

company (create shareholder wealth) are made.

• Companies should ensure that investments are only accepted if

they increase the value of the company.

Methods of ranking projects/ investments:

Basic methods:

• Accounting rate of return

• Payback period

• Discounted payback period

Discounted cash flow methods:

• Net present value method

• Internal rate of return

13