Page 17 - PowerPoint Presentation

P. 17

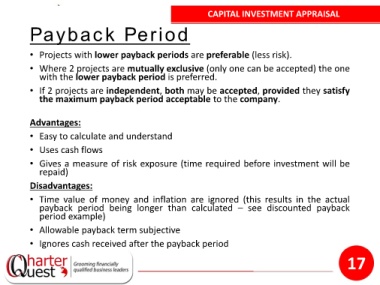

CAPITAL INVESTMENT APPRAISAL

Payback Period

• Projects with lower payback periods are preferable (less risk).

• Where 2 projects are mutually exclusive (only one can be accepted) the one

with the lower payback period is preferred.

• If 2 projects are independent, both may be accepted, provided they satisfy

the maximum payback period acceptable to the company.

Advantages:

• Easy to calculate and understand

• Uses cash flows

• Gives a measure of risk exposure (time required before investment will be

repaid)

Disadvantages:

• Time value of money and inflation are ignored (this results in the actual

payback period being longer than calculated – see discounted payback

period example)

• Allowable payback term subjective

• Ignores cash received after the payback period

17