Page 344 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 344

Chapter 20

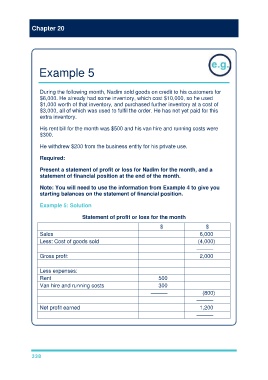

Example 5

During the following month, Nadim sold goods on credit to his customers for

$6,000. He already had some inventory, which cost $10,000, so he used

$1,000 worth of that inventory, and purchased further inventory at a cost of

$3,000, all of which was used to fulfil the order. He has not yet paid for this

extra inventory.

His rent bill for the month was $500 and his van hire and running costs were

$300.

He withdrew $200 from the business entity for his private use.

Required:

Present a statement of profit or loss for Nadim for the month, and a

statement of financial position at the end of the month.

Note: You will need to use the information from Example 4 to give you

starting balances on the statement of financial position.

Example 5: Solution

Statement of profit or loss for the month

$ $

Sales 6,000

Less: Cost of goods sold (4,000)

–——–

Gross profit 2,000

Less expenses:

Rent 500

Van hire and running costs 300

–——– (800)

–——–

Net profit earned 1,200

–——–

338