Page 393 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 393

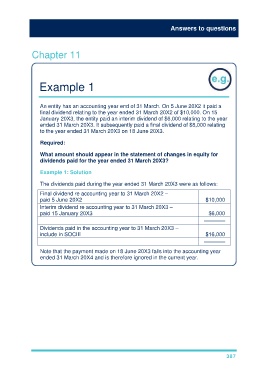

Answers to questions

Chapter 11

Example 1

An entity has an accounting year end of 31 March. On 5 June 20X2 it paid a

final dividend relating to the year ended 31 March 20X2 of $10,000. On 15

January 20X3, the entity paid an interim dividend of $6,000 relating to the year

ended 31 March 20X3. It subsequently paid a final dividend of $8,000 relating

to the year ended 31 March 20X3 on 18 June 20X3.

Required:

What amount should appear in the statement of changes in equity for

dividends paid for the year ended 31 March 20X3?

Example 1: Solution

The dividends paid during the year ended 31 March 20X3 were as follows:

Final dividend re accounting year to 31 March 20X2 –

paid 5 June 20X2 $10,000

Interim dividend re accounting year to 31 March 20X3 –

paid 15 January 20X3 $6,000

–––––––

Dividends paid in the accounting year to 31 March 20X3 –

include in SOCIE $16,000

–––––––

Note that the payment made on 18 June 20X3 falls into the accounting year

ended 31 March 20X4 and is therefore ignored in the current year.

387