Page 396 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 396

Chapter 20

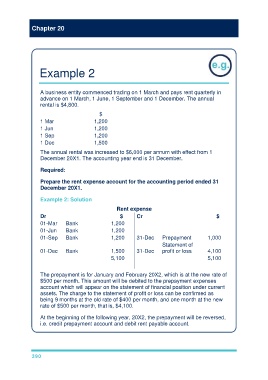

Example 2

A business entity commenced trading on 1 March and pays rent quarterly in

advance on 1 March, 1 June, 1 September and 1 December. The annual

rental is $4,800.

$

1 Mar 1,200

1 Jun 1,200

1 Sep 1,200

1 Dec 1,500

The annual rental was increased to $6,000 per annum with effect from 1

December 20X1. The accounting year end is 31 December.

Required:

Prepare the rent expense account for the accounting period ended 31

December 20X1.

Example 2: Solution

Rent expense

Dr $ Cr $

01-Mar Bank 1,200

01-Jun Bank 1,200

01-Sep Bank 1,200 31-Dec Prepayment 1,000

Statement of

01-Dec Bank 1,500 31-Dec profit or loss 4,100

5,100 5,100

The prepayment is for January and February 20X2, which is at the new rate of

$500 per month. This amount will be debited to the prepayment expenses

account which will appear on the statement of financial position under current

assets. The charge to the statement of profit or loss can be confirmed as

being 9 months at the old rate of $400 per month, and one month at the new

rate of $500 per month, that is, $4,100.

At the beginning of the following year, 20X2, the prepayment will be reversed,

i.e. credit prepayment account and debit rent payable account.

390