Page 50 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 50

Chapter 2

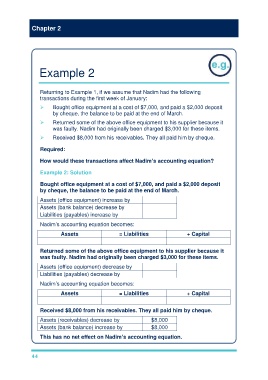

Example 2

Returning to Example 1, if we assume that Nadim had the following

transactions during the first week of January:

Bought office equipment at a cost of $7,000, and paid a $2,000 deposit

by cheque, the balance to be paid at the end of March.

Returned some of the above office equipment to his supplier because it

was faulty. Nadim had originally been charged $3,000 for these items.

Received $8,000 from his receivables. They all paid him by cheque.

Required:

How would these transactions affect Nadim’s accounting equation?

Example 2: Solution

Bought office equipment at a cost of $7,000, and paid a $2,000 deposit

by cheque, the balance to be paid at the end of March.

Assets (office equipment) increase by

Assets (bank balance) decrease by

Liabilities (payables) increase by

Nadim’s accounting equation becomes:

Assets = Liabilities + Capital

Returned some of the above office equipment to his supplier because it

was faulty. Nadim had originally been charged $3,000 for these items.

Assets (office equipment) decrease by

Liabilities (payables) decrease by

Nadim’s accounting equation becomes:

Assets = Liabilities + Capital

Received $8,000 from his receivables. They all paid him by cheque.

Assets (receivables) decrease by $8,000

Assets (bank balance) increase by $8,000

This has no net effect on Nadim’s accounting equation.

44