Page 87 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 87

From trial balance to financial statements

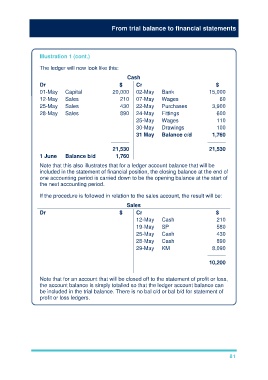

Illustration 1 (cont.)

The ledger will now look like this:

Cash

Dr $ Cr $

01-May Capital 20,000 02-May Bank 15,000

12-May Sales 210 07-May Wages 60

25-May Sales 430 22-May Purchases 3,900

28-May Sales 890 24-May Fittings 600

25-May Wages 110

30-May Drawings 100

31 May Balance c/d 1,760

–––––– ––––––

21,530 21,530

1 June Balance b/d 1,760

Note that this also illustrates that for a ledger account balance that will be

included in the statement of financial position, the closing balance at the end of

one accounting period is carried down to be the opening balance at the start of

the next accounting period.

If the procedure is followed in relation to the sales account, the result will be:

Sales

Dr $ Cr $

12-May Cash 210

19-May SP 580

25-May Cash 430

28-May Cash 890

29-May KM 8,090

––––––

10,200

Note that for an account that will be closed off to the statement of profit or loss,

the account balance is simply totalled so that the ledger account balance can

be included in the trial balance. There is no bal c/d or bal b/d for statement of

profit or loss ledgers.

81