Page 41 - Taxation F6

P. 41

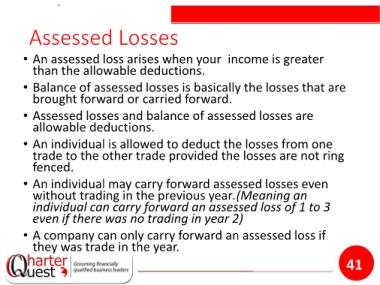

Assessed Losses

• An assessed loss arises when your income is greater

than the allowable deductions.

• Balance of assessed losses is basically the losses that are

brought forward or carried forward.

• Assessed losses and balance of assessed losses are

allowable deductions.

• An individual is allowed to deduct the losses from one

trade to the other trade provided the losses are not ring

fenced.

• An individual may carry forward assessed losses even

without trading in the previous year.(Meaning an

individual can carry forward an assessed loss of 1 to 3

even if there was no trading in year 2)

• A company can only carry forward an assessed loss if

they was trade in the year.

41