Page 4 - 5.3 i. Taxation ITC Summarised Notes part 4

P. 4

ITC EXAM PREP

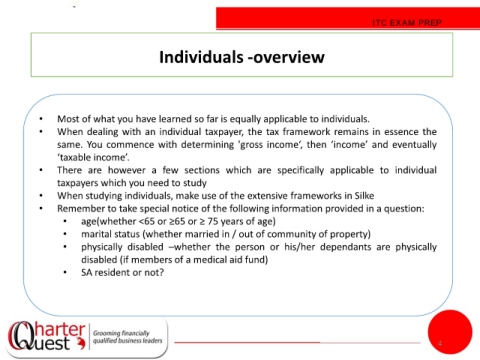

Individuals -overview

• Most of what you have learned so far is equally applicable to individuals.

• When dealing with an individual taxpayer, the tax framework remains in essence the

same. You commence with determining 'gross income‘, then ‘income’ and eventually

‘taxable income’.

• There are however a few sections which are specifically applicable to individual

taxpayers which you need to study

• When studying individuals, make use of the extensive frameworks in Silke

• Remember to take special notice of the following information provided in a question:

• age(whether <65 or ≥65 or ≥ 75 years of age)

• marital status (whether married in / out of community of property)

• physically disabled –whether the person or his/her dependants are physically

disabled (if members of a medical aid fund)

• SA resident or not?

4