Page 6 - 5.3 i. Taxation ITC Summarised Notes part 4

P. 6

ITC EXAM PREP

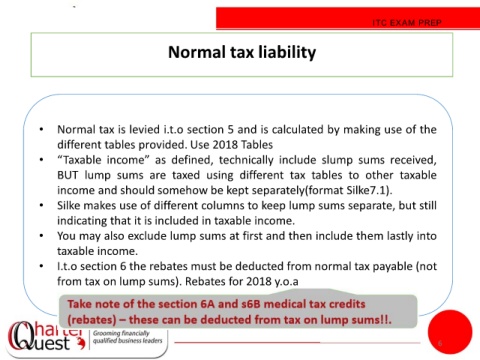

Normal tax liability

• Normal tax is levied i.t.o section 5 and is calculated by making use of the

different tables provided. Use 2018 Tables

• “Taxable income” as defined, technically include slump sums received,

BUT lump sums are taxed using different tax tables to other taxable

income and should somehow be kept separately(format Silke7.1).

• Silke makes use of different columns to keep lump sums separate, but still

indicating that it is included in taxable income.

• You may also exclude lump sums at first and then include them lastly into

taxable income.

• I.t.o section 6 the rebates must be deducted from normal tax payable (not

from tax on lump sums). Rebates for 2018 y.o.a

6