Page 11 - PowerPoint Presentation

P. 11

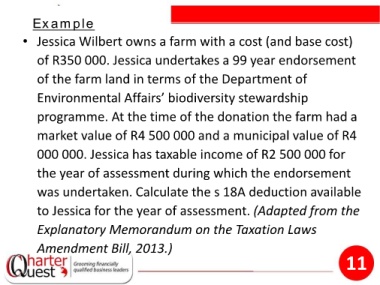

Example

• Jessica Wilbert owns a farm with a cost (and base cost)

of R350 000. Jessica undertakes a 99 year endorsement

of the farm land in terms of the Department of

Environmental Affairs’ biodiversity stewardship

programme. At the time of the donation the farm had a

market value of R4 500 000 and a municipal value of R4

000 000. Jessica has taxable income of R2 500 000 for

the year of assessment during which the endorsement

was undertaken. Calculate the s 18A deduction available

to Jessica for the year of assessment. (Adapted from the

Explanatory Memorandum on the Taxation Laws

Amendment Bill, 2013.)

11