Page 12 - PowerPoint Presentation

P. 12

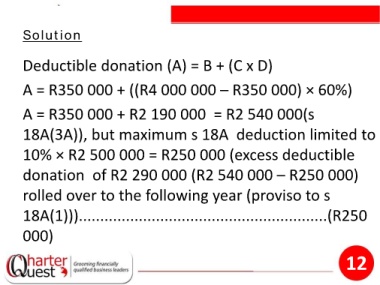

Solution

Deductible donation (A) = B + (C x D)

A = R350 000 + ((R4 000 000 – R350 000) × 60%)

A = R350 000 + R2 190 000 = R2 540 000(s

18A(3A)), but maximum s 18A deduction limited to

10% × R2 500 000 = R250 000 (excess deductible

donation of R2 290 000 (R2 540 000 – R250 000)

rolled over to the following year (proviso to s

18A(1)))..........................................................(R250

000)

12