Page 29 - Chapter 32 - VAT Part 1

P. 29

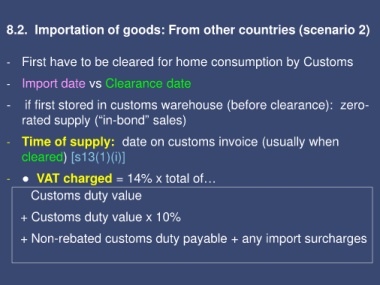

8.2. Importation of goods: From other countries (scenario 2)

- First have to be cleared for home consumption by Customs

- Import date vs Clearance date

- if first stored in customs warehouse (before clearance): zero-

rated supply (“in-bond” sales)

- Time of supply: date on customs invoice (usually when

cleared) [s13(1)(i)]

- ● VAT charged = 14% x total of…

Customs duty value

+ Customs duty value x 10%

+ Non-rebated customs duty payable + any import surcharges