Page 31 - Chapter 32 - VAT Part 1

P. 31

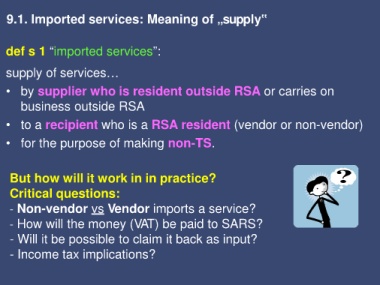

9.1. Imported services: Meaning of „supply‟

def s 1 “imported services”:

supply of services…

• by supplier who is resident outside RSA or carries on

business outside RSA

• to a recipient who is a RSA resident (vendor or non-vendor)

• for the purpose of making non-TS.

But how will it work in in practice?

Critical questions:

- Non-vendor vs Vendor imports a service?

- How will the money (VAT) be paid to SARS?

- Will it be possible to claim it back as input?

- Income tax implications?