Page 46 - FINAL CFA II SLIDES JUNE 2019 DAY 3

P. 46

LOS 9.c: Explain the requirement for a time series to be

covariance stationary and describe the significance of a READING 9: TIME SERIES ANALYSIS

series that is not stationary.

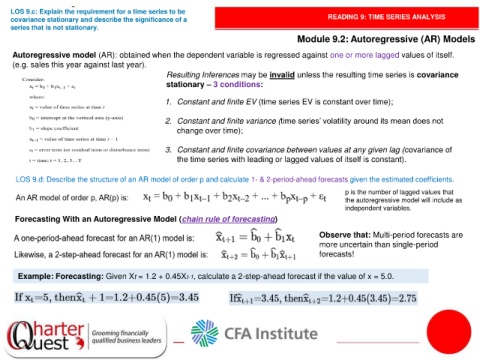

Module 9.2: Autoregressive (AR) Models

Autoregressive model (AR): obtained when the dependent variable is regressed against one or more lagged values of itself.

(e.g. sales this year against last year).

Resulting Inferences may be invalid unless the resulting time series is covariance

stationary – 3 conditions:

1. Constant and finite EV (time series EV is constant over time);

2. Constant and finite variance (time series’ volatility around its mean does not

change over time);

3. Constant and finite covariance between values at any given lag (covariance of

the time series with leading or lagged values of itself is constant).

LOS 9.d: Describe the structure of an AR model of order p and calculate 1- & 2-period-ahead forecasts given the estimated coefficients.

p is the number of lagged values that

the autoregressive model will include as

independent variables.

Forecasting With an Autoregressive Model (chain rule of forecasting)

Observe that: Multi-period forecasts are

more uncertain than single-period

forecasts!

Example: Forecasting: Given Xt = 1.2 + 0.45Xt-1, calculate a 2-step-ahead forecast if the value of x = 5.0.