Page 47 - FINAL CFA II SLIDES JUNE 2019 DAY 3

P. 47

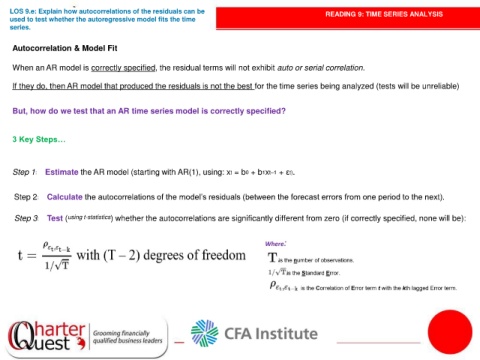

LOS 9.e: Explain how autocorrelations of the residuals can be READING 9: TIME SERIES ANALYSIS

used to test whether the autoregressive model fits the time

series.

Autocorrelation & Model Fit

When an AR model is correctly specified, the residual terms will not exhibit auto or serial correlation.

If they do, then AR model that produced the residuals is not the best for the time series being analyzed (tests will be unreliable)

But, how do we test that an AR time series model is correctly specified?

3 Key Steps…

Step 1: Estimate the AR model (starting with AR(1), using: xt = b0 + b1xt–1 + εt).

Step 2: Calculate the autocorrelations of the model’s residuals (between the forecast errors from one period to the next).

Step 3: Test ( using t-statistics ) whether the autocorrelations are significantly different from zero (if correctly specified, none will be):