Page 129 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 129

Investment appraisal techniques

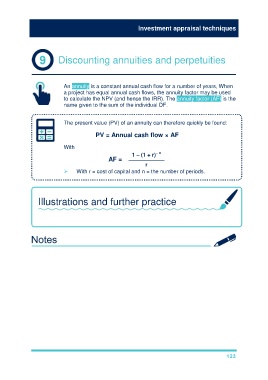

Discounting annuities and perpetuities

An annuity is a constant annual cash flow for a number of years, When

a project has equal annual cash flows, the annuity factor may be used

to calculate the NPV (and hence the IRR). The annuity factor (AF) is the

name given to the sum of the individual DF.

The present value (PV) of an annuity can therefore quickly be found:

PV = Annual cash flow × AF

With

– n

1 – (1 + r)

AF = ––––––––––––

r

With r = cost of capital and n = the number of periods.

Illustrations and further practice

Now read illustration ‘Annuities’ illustration from Chapter 10.

123