Page 135 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 135

Further aspects of investment appraisal

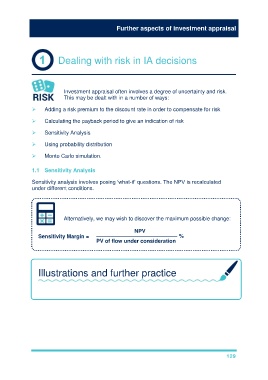

Dealing with risk in IA decisions

Investment appraisal often involves a degree of uncertainty and risk.

This may be dealt with in a number of ways:

Adding a risk premium to the discount rate in order to compensate for risk

Calculating the payback period to give an indication of risk

Sensitivity Analysis

Using probability distribution

Monte Carlo simulation.

1.1 Sensitivity Analysis

Sensitivity analysis involves posing ‘what-if’ questions. The NPV is recalculated

under different conditions.

Alternatively, we may wish to discover the maximum possible change:

NPV

––––––––––––––––––––––––––– %

Sensitivity Margin =

PV of flow under consideration

Illustrations and further practice

Now try example 1 ‘Amador Ltd’ from Chapter 11.

129