Page 6 - Kirstie Test BenSum

P. 6

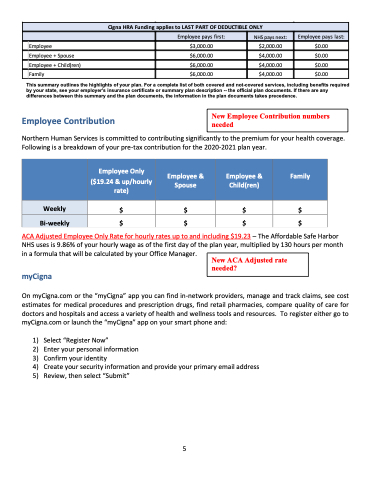

Cigna HRA Funding applies to LAST PART OF DEDUCTIBLE ONLY

Employee pays first:

NHS pays next:

Employee pays last:

Employee

$3,000.00

$2,000.00

$0.00

Employee + Spouse

$6,000.00

$4,000.00

$0.00

Employee + Child(ren)

$6,000.00

$4,000.00

$0.00

Family

$6,000.00

$4,000.00

$0.00

This summary outlines the highlights of your plan. For a complete list of both covered and not-covered services, including benefits required by your state, see your employer's insurance certificate or summary plan description -- the official plan documents. If there are any differences between this summary and the plan documents, the information in the plan documents takes precedence.

Employee Contribution

Northern Human Services is committed to contributing significantly to the premium for your health coverage. Following is a breakdown of your pre-tax contribution for the 2020-2021 plan year.

Employee Only

($19.24 & up/hourly rate)

Employee & Spouse

Employee & Child(ren)

Family

Weekly

$

$

$

$

Bi-weekly

$

$

$

$

ACA Adjusted Employee Only Rate for hourly rates up to and including $19.23 – The Affordable Safe Harbor NHS uses is 9.86% of your hourly wage as of the first day of the plan year, multiplied by 130 hours per month in a formula that will be calculated by your Office Manager.

myCigna

On myCigna.com or the “myCigna” app you can find in-network providers, manage and track claims, see cost estimates for medical procedures and prescription drugs, find retail pharmacies, compare quality of care for doctors and hospitals and access a variety of health and wellness tools and resources. To register either go to myCigna.com or launch the “myCigna” app on your smart phone and:

1) Select “Register Now”

2) Enter your personal information

3) Confirm your identity

4) Create your security information and provide your primary email address

5) Review, then select “Submit”

5

New Employee Contribution numbers needed

New ACA Adjusted rate needed?