Page 122 - Microsoft Word - Annual Report 2016

P. 122

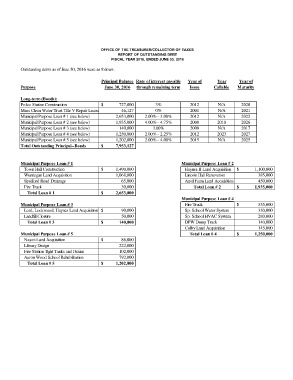

OFFICE OF THE TREASURER/COLLECTOR OF TAXES

REPORT OF OUTSTANDING DEBT

FISCAL YEAR 2016, ENDED JUNE 30, 2016

Outstanding debts as of June 30, 2016 were as follows:

Principal Balance Rate of interest payable Year of Year Year of

Purpose June 30, 2016 through remaining term Issue Callable Maturity

Long-term (Bonds):

Police Station Construction $ 727,000 3% 2012 N/A 2020

Mass Clean Water Trust Title V Repair Loans 46,127 0% 2001 N/A 2021

Municipal Purpose Loan # 1 (see below) 2,653,000 2.00% - 3.00% 2012 N/A 2022

Municipal Purpose Loan # 2 (see below) 1,935,000 4.00% - 4.75% 2008 2018 2026

Municipal Purpose Loan # 3 (see below) 140,000 3.00% 2009 N/A 2017

Municipal Purpose Loan # 4 (see below) 1,250,000 2.00% - 2.25% 2012 2023 2027

Municipal Purpose Loan # 5 (see below) 1,202,000 2.00% - 4.00% 2015 N/A 2025

Total Outstanding Principal--Bonds $ 7,953,127

Municipal Purpose Loan # 1 Municipal Purpose Loan # 2

Town Hall Construction $ 1,490,000 Haynes II Land Acquisition $ 1,100,000

Wunnegan Land Acquisition 1,068,000 Lincoln Hall Renovation 385,000

Spofford Road Drainage 65,000 Anvil Farm Land Acquisition 450,000

Fire Truck 30,000 Total Loan # 2 $ 1,935,000

Total Loan # 1 $ 2,653,000

Municipal Purpose Loan # 4

Municipal Purpose Loan # 3 Fire Truck $ 355,000

Lord, Lockwood, Haynes Land Acquisition $ 90,000 Sp. School Water System 330,000

Landfill Closure 50,000 Sp. School HVAC System 280,000

Total Loan # 3 $ 140,000 DPW Dump Truck 140,000

Colby Land Acquisition 145,000

Municipal Purpose Loan # 5 Total Loan # 4 $ 1,250,000

Nason Land Acquisition $ 86,000

Library Design 222,000

Fire Station Tight Tanks and Drains 102,000

Aaron Wood School Rehabilitation 792,000

Total Loan # 5 $ 1,202,000