Page 47 - CFPA-SCR-Award in General Insurance W01_2018-19_Neat

P. 47

Chapter 2 The insurance market 2/9

The choice of distribution will influence the type of advertising used, for example, whether it is to be

aimed at intermediaries or the general public. It will also have an impact on costs relating to staff,

premises and IT equipment.

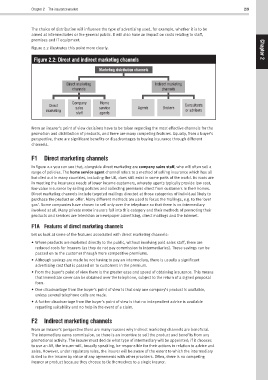

Figure 2.2 illustrates this point more clearly. Chapter

Figure 2.2: Direct and indirect marketing channels 2

Marketing distribution channels

Direct marketing Indirect marketing

channels channels

Company Home

Direct sales service Agents Brokers Consultants

marketing or advisers

staff agents

From an insurer’s point of view decisions have to be taken regarding the most effective channels for the

promotion and distribution of products, and there are many competing features. Equally, from a buyer’s

perspective, there are significant benefits or disadvantages to buying insurance through different

channels.

F1 Direct marketing channels

In figure 2.2 you can see that, alongside direct marketing are company sales staff, who will often sell a

range of policies. The home service agent channel refers to a method of selling insurance which has all

but died out in many countries, including the UK, does still exist in some parts of the world. Its roots are

in meeting the insurance needs of lower income customers, whereby agents typically provide low cost,

low value insurance by selling policies and collecting premiums direct from customers in their homes.

Direct marketing channels include targeted mailings directed at those categories of individual likely to

purchase the product on offer. Many different methods are used to focus the mailings, e.g. to the ‘over

50s’. Some companies have chosen to sell only over the telephone so that there is no intermediary

involved at all. Many private motor insurers fall into this category and their methods of promoting their

products and services are television or newspaper advertising, direct mailings and the internet.

F1A Features of direct marketing channels

Let us look at some of the features associated with direct marketing channels:

• Where products are marketed directly to the public, without involving paid sales staff, there are

reduced costs for insurers (as they do not pay commission to intermediaries). These savings can be

passed on to the customer through more competitive premiums.

• Although savings are made by not having to pay an intermediary, there is usually a significant

advertising cost that is passed on to customers in the premium.

• From the buyer’s point of view there is the greater ease and speed of obtaining insurance. This means

that immediate cover can be obtained over the telephone, subject to the return of a signed proposal

form.

• One disadvantage from the buyer’s point of view is that only one company’s product is available,

unless several telephone calls are made.

• A further disadvantage from the buyer’s point of view is that no independent advice is available

regarding suitability and no help in the event of a claim.

F2 Indirect marketing channels

From an insurer’s perspective there are many reasons why indirect marketing channels are beneficial.

The intermediary earns commission, so there is an incentive to sell the product and benefits from any

promotional activity. The insurer must decide what type of intermediary will be appointed; if it chooses

to use an AR, the insurer will, broadly speaking, be responsible for their actions in relation to advice and

sales. However, under regulatory rules, the insurer will be aware of the extent to which the intermediary

is tied to the insurer by virtue of any agreements with other providers. Often, there is no competing

insurer or product because they choose to tie themselves to a single insurer.