Page 33 - US Market Performance Report 1Q 2018

P. 33

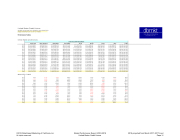

United States Credit Unions

SOURCE: NCUA 5300 CALL REPORTS, 2018 PROJECTED

BASED ON MARCH 2017-2018 YOY TREND

Performance Tables

United States Credit Unions VARIANCE FROM LOAN TOTALS

2008 2009 2010 2011 2012 2013 2014 2015 2016

2017

2018

$0 0.000% 1.000000000000

ANNUAL RATES OF CHANGE

2001 2002 2003 2004 2005 2006 2007

0.20%

-0.15%

0.86% 3.75% 6.32%

11.31% 13.47%

-3.00% -2.99% -1.45% 0.50% 1.40% 6.99% 8.23%

-0.68% 10.46% 0.66% 9.29% 5.36% 12.62%

12.00% 4.38% 18.06% 2.44% 5.80% 1.28% -1.98% 1.69%

16.68% 13.61% 16.54% 10.98% 11.69% 10.33% 12.25%

5.83% 10.31% 9.23% 2.13% 7.90% -3.20%

24.20% 4.12% 18.54% -7.95% 15.20% -19.22%

8.61% -24.53%

2.98%

-0.99%

5.15% 9.24% 4.76% 4.93% 2.23%

6.99% 6.77% 9.78%

10.37% 10.67% 8.11% 6.54%

$33,155,895,062 $35,281,502,011 $36,373,741,377 $37,808,785,843 $39,953,314,516 $43,047,914,142 $46,446,680,362 $49,296,038,789 $53,178,873,051

$25,642,187,666 $25,820,342,157 $25,728,263,264 $25,824,160,370 $27,073,888,238 $29,521,284,598 $32,480,229,102 $35,233,825,455 $37,816,275,486

$82,681,176,392 $76,137,835,817 $63,540,969,553 $58,849,891,775 $63,896,177,983 $71,981,760,949 $87,016,310,167

$100,929,648,777 $117,919,858,368

$95,518,433,895

$99,270,118,587 $102,628,826,914 $107,851,657,919 $116,398,755,470 $128,581,943,575 $145,110,443,805 $163,605,490,085 $183,905,287,460

$211,578,307,443 $220,674,462,192 $226,610,980,896 $236,072,052,152 $250,062,633,833 $271,758,934,086 $296,478,093,261 $326,908,920,464 $359,016,525,104

$98,128,527,831 $93,755,136,864 $87,796,878,700 $81,569,956,903 $74,950,308,084 $71,920,632,975 $72,871,219,033 $75,396,387,647 $78,021,775,880

$744,282,347 $606,007,254 $480,408,704 $440,277,349 $537,247,940 $777,789,810

$1,008,903,141 $1,235,050,244 $1,923,426,965

$27,303,315,077 $28,908,832,572 $29,285,119,934 $30,556,199,003 $32,398,602,855 $35,470,004,859 $39,376,099,444 $43,861,596,994 $47,995,269,810

$574,752,125,713 $580,454,237,454 $572,445,189,342 $578,972,981,314 $605,270,928,919 $653,060,264,994 $720,787,978,315 $796,466,958,455 $879,777,292,124

LOAN ACCOUNT BALANCES

2000 2001 2002 2003 2004 2005 2006 2007

Credit Cards Other Unsecured New Vehicle Used Vehicle 1st TD 2nd TD Leases Other TOTAL

$21,915,554,834 $21,958,546,191 $21,925,739,904 $22,114,914,833 $22,944,596,628 $24,394,196,570 $27,153,107,347 $30,811,822,680

$22,674,336,641 $21,993,609,998 $21,336,530,628 $21,026,414,924 $21,130,692,405 $21,426,895,342 $22,924,287,934 $24,810,509,177

$61,269,964,184 $60,850,785,502 $61,253,402,297 $64,534,027,978 $72,277,983,330 $85,327,849,128 $90,275,292,332 $88,491,506,763

$60,723,772,738 $67,076,783,274 $73,309,553,156 $82,562,387,516 $86,175,243,514 $88,282,224,259 $89,410,049,133 $90,917,515,249

$77,719,759,451

$90,681,159,158 $103,024,426,168 $120,067,189,196 $133,245,128,431 $148,819,319,330 $164,193,126,723 $184,309,833,431

$40,719,692,360 $43,094,404,625 $47,072,648,930 $50,789,477,022 $63,078,518,632 $74,775,881,880 $86,144,224,357 $93,561,998,854

$1,378,278,186 $1,520,428,783 $1,552,857,270 $1,503,187,413 $1,565,182,120 $1,440,728,731 $1,163,762,428

$878,316,327

$18,859,424,914 $19,421,606,077 $19,230,217,344 $20,220,038,868 $22,088,738,298 $23,140,545,015 $24,280,562,929 $24,821,308,278

$305,260,783,308 $326,597,323,608 $348,705,375,697 $382,817,637,750 $422,506,083,358 $467,607,640,255 $505,544,413,183 $538,602,810,759

$58,032,786,209 $41,025,354,351 $133,324,357,713 $202,592,592,766 $341,382,900,583 $80,364,947,567 $3,420,509,912 $107,739,040,114 $967,882,489,215

$63,719,597,383 $44,114,157,891 $149,466,285,025 $222,806,237,387 $325,576,521,157 $80,157,238,315 $5,796,601,470 $170,293,381,827 $1,061,930,020,456

#$

$0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000% $0 0. 000%

1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000 1.000000000000

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

7.61% 6.41% 3.10% 3.95% 5.67% 7.75% 7.90% 6.13% 7.88% 9.13%

3.35% -6.57% 0.69% -7.91% -0.36% -16.54% 0.37% -7.38% 4.84% 8.57% 9.04% 12.65% 10.02% 20.89% 8.48% 15.99% 7.33% 16.83% 8.49% 13.06%

5.06% 14.79% 3.93% 4.30% 3.38% 2.69% 5.09% 4.18% 7.92% 5.93%

10.47% 8.68% 12.85% 9.10% 12.75% 10.26% 12.41% 9.82% 10.16% -4.91%

4.88% -15.26% -4.46% -18.58% -6.36% -20.73% -7.09% -8.35% -8.12% 22.02% -4.04% 44.77% 1.32% 29.71% 3.47% 22.42% 3.48% 55.74% 3.00% 77.83%

10.00% 5.88% 1.30% 4.34% 6.03% 9.48%

11.01% 11.39% 9.42% 124.48%

6.71% 0.99% -1.38% 1.14% 4.54% 7.90% 10.37% 10.50% 10.46% 10.01%

2018

9.80% 7.53% 12.11% 9.98% -4.63% -0.26% 69.47% 58.06% 9.72%

©2018 Data Based Marketing of California, Inc. All rights reserved.

Market Performance Report: 2000-2018 United States Credit Unions

2018 projected from March 2017-2017 trend Page 31