Page 35 - US Market Performance Report 1Q 2018

P. 35

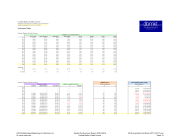

United States Credit Unions

SOURCE: NCUA 5300 CALL REPORTS, 2018 PROJECTED

BASED ON MARCH 2017-2018 YOY TREND

Performance Tables

United States Credit Unions

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

14.24% 11.28% 14.44% 11.12% 14.59% 10.94% 14.80% 10.86% 15.27% 11.27% 15.94% 11.72% 16.59% 12.05% 17.04% 12.13% 17.31% 12.29% 17.45% 12.10%

6.26% 10.83% 1.81% 5.92% 11.21% 1.83% 5.02% 11.41% 1.88% 4.36% 11.59% 1.96% 4.20% 11.91% 2.07% 4.22% 12.44% 2.16% 4.64% 12.99% 2.24% 5.00% 13.53% 2.31% 5.46% 14.08% 2.35% 5.84% 14.63% 2.34%

3.10% 0.04% 2.92% 0.04% 2.75% 0.03% 2.56% 0.02% 2.34% 0.02% 2.22% 0.03% 2.17% 0.03% 2.13% 0.04% 2.07% 0.06% 2.02% 0.10%

3.18% 3.43% 3.38% 3.62% 3.54% 3.59% 3.57% 3.64% 3.58% 3.53%

MEMBER LOAN PENETRATION

2000 2001 2002 2003 2004 2005 2006 2007

Credit Cards Other Unsecured New Vehicle Used Vehicle 1st TD 2nd TD Leases Other

17.27% 12.31% 16.55% 11.87% 15.72% 11.41% 15.31% 11.13% 14.63% 10.97% 14.27% 11.02% 14.08% 11.11% 14.29% 11.44%

5.94% 9.50% 1.35% 5.69% 9.76% 1.40% 5.45% 10.03% 1.46% 5.30% 10.65% 1.54% 5.54% 10.91% 1.56% 6.12% 10.92% 1.61% 6.49% 10.75% 1.66% 6.49% 10.63% 1.72%

2.32% 0.09% 2.31% 0.09% 2.34% 0.09% 2.35% 0.08% 2.63% 0.08% 2.85% 0.07% 3.05% 0.06% 3.11% 0.04%

3.92% 3.70% 3.43% 3.27% 3.25% 3.26% 3.09% 3.04%

2018

17.58% 12.02% 6.25% 15.18% 2.34% 1.93% 0.17% 3.40%

CA AVERAGES

2018 19.51% 9.71% 7.12% 13.16% 1.74% 1.97% 0.00% 2.05%

US'sRatio 0.89 1.25 0.82 1.11 1.35 1.02 23.83 1.72

United States Credit Unions

INDIRECT AS %

NET CHANGE IN VEH LOANS

INDIRECT LOANS

# Indirect Indirect Balance Avg. Indirect

ANNUAL GROWTH RATES

# $ Balance

OF ALL VEHICLES

#$

LESS INDIRECT

#$

2000 2001 2002 2003 2004 2005 2006 2007

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

3,705,629 4,473,265 4,969,013 5,133,523

$52,110,724,998 $65,567,301,490 $70,864,557,449 $70,549,670,416

$14,063 $14,658 $14,261 $13,743

5,422,581 5,700,308 5,472,530 5,304,112 5,601,435 6,166,425 7,081,785 8,148,804 9,535,399

10,974,361

$75,062,872,940 $76,430,448,206 $71,726,477,712 $71,029,383,111 $78,781,655,041 $93,418,981,685

$113,850,440,126 $137,277,149,674 $166,246,185,319 $195,701,017,593

$13,843 $13,408 $13,107 $13,391 $14,065 $15,150 $16,077 $16,846 $17,435 $17,833

0 $0 $0 0 $0 $0 0 $0 $0 0 $0 $0

2018

©2018 Data Based Marketing of California, Inc. Market Performance Report: 2000-2018 2018 projected from March 2017-2017 trend All rights reserved. United States Credit Unions Page 33

12,587,073 $228,235,424,910 $18,133

0.00% 0.00% 0.00% 0.00%

20.72% 11.08% 3.31%

0.00% 0.00% 0.00% 0.00%

25.82% 8.08% -0.44%

5.63% 5.12% -4.00% -3.08% 5.61% 10.09% 14.84% 15.07% 17.02% 15.09%

6.40% 1.82% -6.15% -0.97% 10.91% 18.58% 21.87% 20.58% 21.10% 17.72%

14.70% 16.62%

0% 0% 0% 0% 0% 0% 0% 0%

27% 33% 31% 38% 33% 39% 34% 39%

35% 42%

36% 44%

36% 43%

36% 43%

37% 44%

38% 47%

40% 49% 42% 52% 45% 55% 48% 58%

50% 61%

291,742 294,743 624,367

-3,076,503 -66,966 -83,539 -78,369 -82,274 -15,965 -321,242 -70,791 171,705 360,517 568,179 481,518 498,511 465,322

$5,933,831,854

$6,635,386,677 $12,533,460,041 -$40,753,913,648 $1,700,270,051 $778,012,119 $38,567,580 -$5,722,614,249 -$4,159,231,149 -$4,534,187,443 $1,228,847,828 $5,841,111,829 $5,631,444,427 $11,131,591,007 $8,981,675,342 $8,320,971,321 $4,636,972,377

498,164 $3,821,164,617