Page 7 - Caltech Endowment Brochure_FY19

P. 7

CALTECH ENDOWMENT REPORT 2019 CALTECH ENDOWMENT REPORT 2019

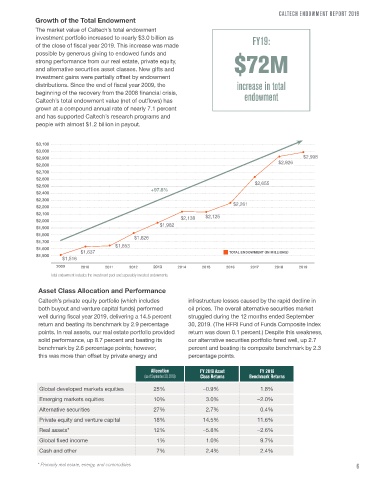

Growth of the Total Endowment

The market value of Caltech’s total endowment

investment portfolio increased to nearly $3.0 billion as FY19:

of the close of fi scal year 2019. This increase was made

possible by generous giving to endowed funds and

strong performance from our real estate, private equity, $72M

and alternative securities asset classes. New gifts and

Barbara Wold (PhD ’78), Bren Professor of investment gains were partially offset by endowment

Molecular Biology, is the newly appointed distributions. Since the end of fi scal year 2009, the increase in total

director of the Richard N. Merkin Institute for beginning of the recovery from the 2008 fi nancial crisis,

Translational Research at Caltech. The institute Caltech’s total endowment value (net of outfl ows) has endowment

was launched in May with a Break Through grown at a compound annual rate of nearly 7.1 percent

campaign gift from trustee Richard Merkin.

and has supported Caltech’s research programs and

people with almost $1.2 billion in payout.

$3,100

$3,000

$2,900 $2,998

$2,800 $2,926

$2,700

$2,600

$2,500 + 97.8% $2,655

$2,400

$2,300

$2,200 $2,261

$2,100 $2,125

$2,000 $2,138

$1,900 $1,982

$1,800 $1,826

$1,700 $1,653

ENDOWMENT PERFORMANCE, FISCAL YEAR 2019 $1,600 $1,637 TOTAL ENDOWMENT IN MILLIONS

$1,500

$1,516

Endowment Investment Pool Return 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Total endowment includes the investment pool and separately invested endowments.

As illustrated in the fi gure below, Caltech’s September 30, 2019, investment pool returns beat

endowment investment pool generated a 5.4 their benchmarks by 2.9, 2.1, and 1.7 percentage

percent return for fi scal year 2019, exceeding its points, respectively. Over the last fi ve years, the Asset Class Allocation and Performance

benchmark policy portfolio by 3.0 percentage points. added value generated by this outperformance of the Caltech’s private equity portfolio (which includes infrastructure losses caused by the rapid decline in

For the three-, fi ve-, and 10-year periods ended policy portfolio was nearly $250 million. both buyout and venture capital funds) performed oil prices. The overall alternative securities market

well during fi scal year 2019, delivering a 14.5 percent struggled during the 12 months ended September

return and beating its benchmark by 2.9 percentage 30, 2019. (The HFRI Fund of Funds Composite Index

15% points. In real assets, our real estate portfolio provided return was down 0.1 percent.) Despite this weakness,

14% solid performance, up 8.7 percent and beating its our alternative securities portfolio fared well, up 2.7

13% benchmark by 2.6 percentage points; however, percent and beating its composite benchmark by 2.3

12% LAST FIVE YEARS: this was more than offset by private energy and percentage points.

11%

10% 10.2%

FY 2019

9% $148M Allocation FY 2019 Asset Benchmark Returns

Class Returns

8% 8.3% (as of September 30, 2019)

7% 7.3% 7.5% 7.3% 7.4% Global developed markets equities 25% −0.9% 1.8%

6% 6.6%

5% 5.4% 5.2% 5.3% in fi nancial aid Emerging markets equities 10% 3.0% −2.0%

4% from endowment Alternative securities 27% 2.7% 0.4%

3%

2% 2.4% 2.7% Private equity and venture capital 18% 14.5% 11.6%

1% Real assets* 12% −5.8% −2.6%

0

1 YEAR 3 YEAR 5 YEAR 10 YEAR

Global fi xed income 1% 1.0% 9.7%

Endowment investment Policy portfolio annualized Cambridge Associates college Cash and other 7% 2.4% 2.4%

pool annualized return benchmark return and university median return

5 * Primarily real estate, energy, and commodities 6