Page 45 - Down East Wood Ducks 2022 Benefits Guide

P. 45

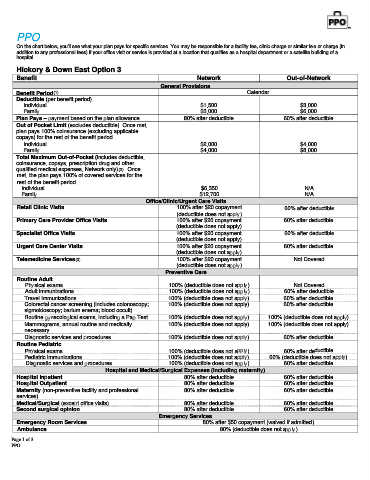

PPO

On the chart below, you'll see what your plan pays for specific services. You may be responsible for a facility fee, clinic charge or similar fee or charge (in

addition to any professional fees) if your office visit or service is provided at a location that qualifies as a hospital department or a satellite building of a

hospital.

Hickory & Down East Option 3

Benefit Network Out-of-Network

General Provisions

Benefit Period(1) Calendar

Deductible (per benefit period)

Individual $1,500 $3,000

Family $3,000 $6,000

Plan Pays – payment based on the plan allowance 80% after deductible 60% after deductible

Out of Pocket Limit (excludes deductible). Once met,

plan pays 100% coinsurance (excluding applicable

copays) for the rest of the benefit period.

Individual $2,000 $4,000

Family $4,000 $8,000

Total Maximum Out-of-Pocket (includes deductible,

coinsurance, copays, prescription drug and other

qualified medical expenses, Network only)(2). Once

met, the plan pays 100% of covered services for the

rest of the benefit period.

Individual $6,350 N/A

Family $12,700 N/A

Office/Clinic/Urgent Care Visits

Retail Clinic Visits 100% after $20 copayment 60% after deductible

(deductible does not apply)

Primary Care Provider Office Visits 100% after $20 copayment 60% after deductible

(deductible does not apply)

Specialist Office Visits 100% after $20 copayment 60% after deductible

(deductible does not apply)

Urgent Care Center Visits 100% after $20 copayment 60% after deductible

(deductible does not apply)

Telemedicine Services(3) 100% after $20 copayment Not Covered

(deductible does not apply)

Preventive Care

Routine Adult

Physical exams 100% (deductible does not apply) Not Covered

Adult immunizations 100% (deductible does not apply) 60% after deductible

Travel Immunizations 100% (deductible does not apply) 60% after deductible

Colorectal cancer screening (includes colonoscopy; 100% (deductible does not apply) 60% after deductible

sigmoidoscopy; barium enema; blood occult)

Routine gynecological exams, including a Pap Test 100% (deductible does not apply) 100% (deductible does not apply)

Mammograms, annual routine and medically 100% (deductible does not apply) 100% (deductible does not apply)

necessary

Diagnostic services and procedures 100% (deductible does not apply) 60% after deductible

Routine Pediatric

Physical exams 100% (deductible does not apply) 60% after deductible

Pediatric immunizations 100% (deductible does not apply) 60% (deductible does not apply)

Diagnostic services and procedures 100% (deductible does not apply) 60% after deductible

Hospital and Medical/Surgical Expenses (including maternity)

Hospital Inpatient 80% after deductible 60% after deductible

Hospital Outpatient 80% after deductible 60% after deductible

Maternity (non-preventive facility and professional 80% after deductible 60% after deductible

services)

Medical/Surgical (except office visits) 80% after deductible 60% after deductible

Second surgical opinion 80% after deductible 60% after deductible

Emergency Services

Emergency Room Services 80% after $50 copayment (waived if admitted)

Ambulance 80% (deductible does not apply)

Page 1 of 3

PPO