Page 46 - Down East Wood Ducks 2022 Benefits Guide

P. 46

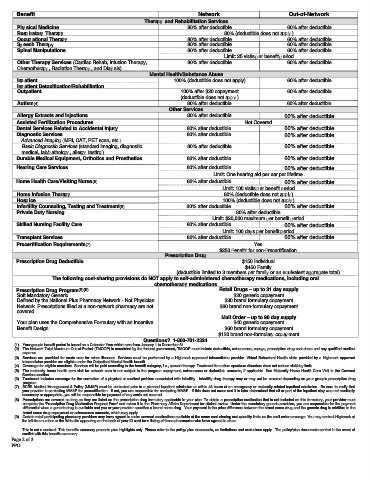

Benefit Network Out-of-Network

Therapy and Rehabilitation Services

Physical Medicine 80% after deductible 60% after deductible

Respiratory Therapy 80% (deductible does not apply)

Occupational Therapy 80% after deductible 60% after deductible

Speech Therapy 80% after deductible 60% after deductible

Spinal Manipulations 80% after deductible 60% after deductible

Limit: 25 visits per benefit period

Other Therapy Services (Cardiac Rehab, Infusion Therapy, 80% after deductible 60% after deductible

Chemotherapy, Radiation Therapy, and Dialysis)

Mental Health/Substance Abuse

Inpatient 100% (deductible does not apply) 60% after deductible

Inpatient Detoxification/Rehabilitation

Outpatient 100% after $20 copayment 60% after deductible

(deductible does not apply)

Autism(4) 80% after deductible 60% after deductible

Other Services

Allergy Extracts and injections 80% after deductible 60% after deductible

Assisted Fertilization Procedures Not Covered

Dental Services Related to Accidental Injury 80% after deductible 60% after deductible

Diagnostic Services 80% after deductible 60% after deductible

Advanced Imaging (MRI, CAT, PET scan, etc.)

Basic Diagnostic Services (standard imaging, diagnostic 80% after deductible 60% after deductible

medical, lab/pathology, allergy testing)

Durable Medical Equipment, Orthotics and Prosthetics 80% after deductible 60% after deductible

Hearing Care Services 80% after deductible 60% after deductible

Limit: One hearing aid per ear per lifetime

Home Health Care/Visiting Nurse(5) 80% after deductible 60% after deductible

Limit: 100 visits per benefit period

Home Infusion Therapy 80% (deductible does not apply)

Hospice 100% (deductible does not apply)

Infertility Counseling, Testing and Treatment(6) 80% after deductible 60% after deductible

Private Duty Nursing 80% after deductible

Limit: $20,000 maximum per benefit period

Skilled Nursing Facility Care 80% after deductible 60% after deductible

Limit: 100 days per benefit period

Transplant Services 80% after deductible 60% after deductible

Precertification Requirements(7) Yes

$250 penalty for non-precertification

Prescription Drug

Prescription Drug Deductible $150 Individual

$450 Family

(deductible limited to 3 members per family or an equivalent aggregate total)

The following cost-sharing provisions do NOT apply to self-administered chemotherapy medications, including oral

chemotherapy medications

Prescription Drug Program(8)(9) Retail Drugs – up to 31 day supply

Soft Mandatory Generic $20 generic copayment

Defined by the National Plus Pharmacy Network - Not Physician $30 brand formulary copayment

Network. Prescriptions filled at a non-network pharmacy are not $60 brand non-formulary copayment

covered.

Mail Order – up to 90 day supply

Your plan uses the Comprehensive Formulary with an Incentive $40 generic copayment

Benefit Design $60 brand formulary copayment

$120 brand non-formulary copayment

Questions? 1-800-701-2324

(1) Your group's benefit period is based on a Calendar Year which runs from January 1 to December 31.

(2) The Network Total Maximum Out-of-Pocket (TMOOP) is mandated by the federal government, TMOOP must include deductible, coinsurance, copays, prescription drug cost share and any qualified medical

expense.

(3) Services are provided for acute care for minor illnesses. Services must be performed by a Highmark approved telemedicine provider. Virtual Behavioral Health visits provided by a Highmark approved

telemedicine provider are eligible under the Outpatient Mental Health benefit.

(4) Coverage for eligible members. Services will be paid according to the benefit category, i.e., speech therapy. Treatment for autism spectrum disorders does not reduce visit/day limits.

(5) The maternity home health care visit for network care is not subject to the program copayment, coinsurance or deductible amounts, if applicable. See Maternity Home Health Care Visit in the Covered

Services section.

(6) Treatment includes coverage for the correction of a physical or medical problem associated with infertility. Infertility drug therapy may or may not be covered depending on your group’s prescription drug

program.

(7) BCBS Medical Management & Policy (MM&P) must be contacted prior to a planned inpatient admission or within 48 hours of an emergency or maternity-related inpatient admission. Be sure to verify that

your provider is contacting MM&P for precertification. If not, you are responsible for contacting MM&P. If this does not occur and it is later determined that all or part of the inpatient stay was not medically

necessary or appropriate, you will be responsible for payment of any costs not covered.

(8) Prescriptions are covered as long as they are listed on the prescription drug formulary applicable to your plan. To obtain a prescription medication that is not included on this formulary, your provider must

complete the 'Prescription Drug Medication Request Form' and return it to the Pharmacy Affairs Department for clinical review. Under the mandatory generic provision, you are responsible for the payment

differential when a generic drug is available and you or your provider specifies a brand name drug. Your payment is the price difference between the brand name drug and the generic drug in addition to the

brand name drug copayment or coinsurance amounts, which may apply.

(9) Certain retail participating pharmacy providers may have agreed to make covered medications available at the same cost-sharing and quantity limits as the mail order coverage. You may contact Highmark at

the toll-free number or the Web site appearing on the back of your ID card for a listing of those pharmacies who have agreed to do so.

This is not a contract. This benefits summary presents plan highlights only. Please refer to the policy/ plan documents, as limitations and exclusions apply. The policy/plan documents control in the event of

conflict with this benefits summary.

Page 2 of 3

PPO