Page 6 - Columbia University Retirement Brochure - Officers

P. 6

The Officers’

Retirement Plan

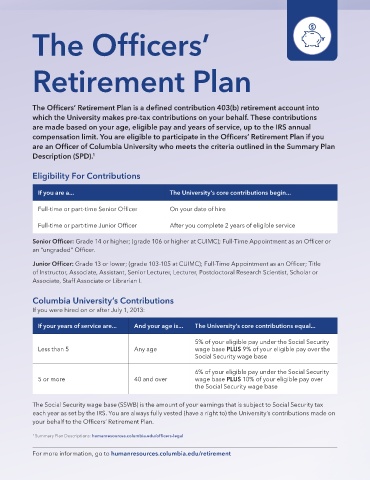

The Officers’ Retirement Plan is a defined contribution 403(b) retirement account into

which the University makes pre-tax contributions on your behalf. These contributions

are made based on your age, eligible pay and years of service, up to the IRS annual

compensation limit. You are eligible to participate in the Officers’ Retirement Plan if you

are an Officer of Columbia University who meets the criteria outlined in the Summary Plan

Description (SPD).

1

Eligibility For Contributions

If you are a... The University’s core contributions begin...

Full-time or part-time Senior Officer On your date of hire

Full-time or part-time Junior Officer After you complete 2 years of eligible service

Senior Officer: Grade 14 or higher; (grade 106 or higher at CUIMC); Full-Time Appointment as an Officer or

an “ungraded” Officer.

Junior Officer: Grade 13 or lower; (grade 103-105 at CUIMC); Full-Time Appointment as an Officer; Title

of Instructor, Associate, Assistant, Senior Lecturer, Lecturer, Postdoctoral Research Scientist, Scholar or

Associate, Staff Associate or Librarian I.

Columbia University’s Contributions

If you were hired on or after July 1, 2013:

If your years of service are... And your age is... The University’s core contributions equal...

5% of your eligible pay under the Social Security

Less than 5 Any age wage base PLUS 9% of your eligible pay over the

Social Security wage base

6% of your eligible pay under the Social Security

5 or more 40 and over wage base PLUS 10% of your eligible pay over

the Social Security wage base

The Social Security wage base (SSWB) is the amount of your earnings that is subject to Social Security tax

each year as set by the IRS. You are always fully vested (have a right to) the University’s contributions made on

your behalf to the Officers’ Retirement Plan.

1 Summary Plan Descriptions: humanresources.columbia.edu/officers-legal

For more information, go to humanresources.columbia.edu/retirement