Page 29 - outbind://23/

P. 29

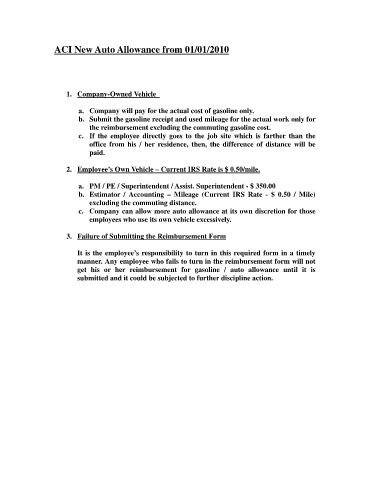

ACI New Auto Allowance from 01/01/2010

1. Company-Owned Vehicle

a. Company will pay for the actual cost of gasoline only.

b. Submit the gasoline receipt and used mileage for the actual work only for

the reimbursement excluding the commuting gasoline cost.

c. If the employee directly goes to the job site which is farther than the

office from his / her residence, then, the difference of distance will be

paid.

2. Employee’s Own Vehicle – Current IRS Rate is $ 0.50/mile.

a. PM / PE / Superintendent / Assist. Superintendent - $ 350.00

b. Estimator / Accounting – Mileage (Current IRS Rate - $ 0.50 / Mile)

excluding the commuting distance.

c. Company can allow more auto allowance at its own discretion for those

employees who use its own vehicle excessively.

3. Failure of Submitting the Reimbursement Form

It is the employee’s responsibility to turn in this required form in a timely

manner. Any employee who fails to turn in the reimbursement form will not

get his or her reimbursement for gasoline / auto allowance until it is

submitted and it could be subjected to further discipline action.