Page 4 - Revelations Group 2 - 2021 Greenbrier Benefit Guide (R2)

P. 4

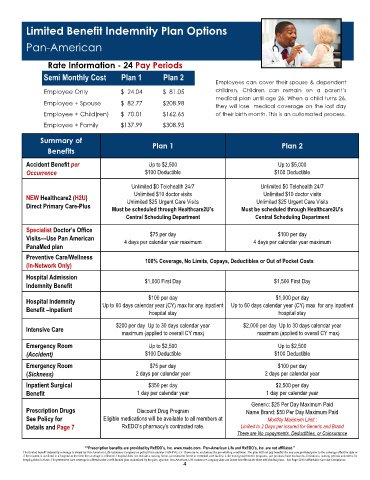

Limited Benefit Indemnity Plan Options

Pan-American

Rate Information - 24 Pay Periods

Semi Monthly Cost Plan 1 Plan 2

Employees can cover their spouse & dependent

Employee Only $ 24.04 $ 81.05 children. Children can remain on a parent’s

medical plan until age 26. When a child turns 26,

Employee + Spouse $ 82.77 $208.98 they will lose medical coverage on the last day

Employee + Child(ren) $ 70.01 $162.65 of their birth month. This is an automated process.

Employee + Family $137.99 $308.95

Summary of Plan 1 Plan 2

Benefits

Accident Benefit per Up to $2,500 Up to $5,000

Occurrence $100 Deductible $100 Deductible

Unlimited $0 Telehealth 24/7 Unlimited $0 Telehealth 24/7

Unlimited $10 doctor visits Unlimited $10 doctor visits

NEW Healthcare2 (H2U) Unlimited $25 Urgent Care Visits Unlimited $25 Urgent Care Visits

Direct Primary Care-Plus Must be scheduled through Healthcare2U’s Must be scheduled through Healthcare2U’s

Central Scheduling Department Central Scheduling Department

Specialist Doctor’s Office $75 per day $100 per day

Visits—Use Pan American 4 days per calendar year maximum 4 days per calendar year maximum

PanaMed plan

Preventive Care/Wellness 100% Coverage, No Limits, Copays, Deductibles or Out of Pocket Costs

(In-Network Only)

Hospital Admission $1,000 First Day $1,500 First Day

Indemnity Benefit

$100 per day $1,000 per day

Hospital Indemnity Up to 60 days calendar year (CY) max for any inpatient Up to 60 days calendar year (CY) max for any inpatient

Benefit –Inpatient hospital stay hospital stay

$200 per day Up to 30 days calendar year $2,000 per day Up to 30 days calendar year

Intensive Care

maximum (applied to overall CY max) maximum (applied to overall CY max)

Emergency Room Up to $2,500 Up to $2,500

(Accident) $100 Deductible $100 Deductible

Emergency Room $75 per day $100 per day

(Sickness) 2 days per calendar year 2 days per calendar year

Inpatient Surgical $350 per day $2,500 per day

Benefit 1 day per calendar year 1 day per calendar year

Generic: $25 Per Day Maximum Paid

Prescription Drugs Discount Drug Program Name Brand: $50 Per Day Maximum Paid

See Policy for Eligible medications will be available to all members at Monthly Maximum Limit :

Details and Page 7 RxEDO’s pharmacy’s contracted rate. Limited to 2 Days per insured for Generic and Brand

There are No copayments, Deductibles, or Coinsurance

*“Prescription benefits are provided by RxEDO's, Inc. www.rxedo.com. Pan-American Life and RxEDO's, Inc. are not affiliated.”

The limited benefit indemnity coverage is issued by Pan-American Life Insurance Company on policy form number PAN-POL-13. There are no exclusions for pre-existing conditions. The plan will not pay benefits for any care provided prior to the coverage effective date or

if the insured is confined in a hospital at the time the coverage is effective. Hospital does not include a nursing home, convalescent home or extended care facility. Like most group benefit programs, our products have exclusions, limitations, waiting periods and terms for

keeping them in force. The preventive care coverage is offered under a self-funded plan maintained by the plan sponsor. Pan-American Life Insurance Company does not insure benefits under these self-funded plans. See Page 20 for Affordable Care Act Compliance.

4