Page 23 - Stamford Residence & Rehabilitation - Benefit Guide 3-1-2021

P. 23

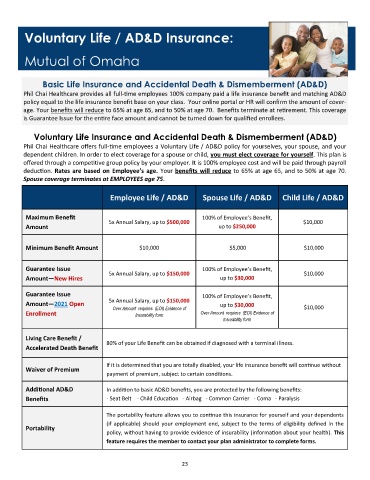

Voluntary Life / AD&D Insurance:

Mutual of Omaha

Basic Life Insurance and Accidental Death & Dismemberment (AD&D)

Phil Chai Healthcare provides all full-time employees 100% company paid a life insurance benefit and matching AD&D

policy equal to the life insurance benefit base on your class. Your online portal or HR will confirm the amount of cover-

age. Your benefits will reduce to 65% at age 65, and to 50% at age 70. Benefits terminate at retirement. This coverage

is Guarantee Issue for the entire face amount and cannot be turned down for qualified enrollees.

Voluntary Life Insurance and Accidental Death & Dismemberment (AD&D)

Phil Chai Healthcare offers full-time employees a Voluntary Life / AD&D policy for yourselves, your spouse, and your

dependent children. In order to elect coverage for a spouse or child, you must elect coverage for yourself. This plan is

offered through a competitive group policy by your employer. It is 100% employee cost and will be paid through payroll

deduction. Rates are based on Employee’s age. Your benefits will reduce to 65% at age 65, and to 50% at age 70.

Spouse coverage terminates at EMPLOYEES age 75.

Employee Life / AD&D Spouse Life / AD&D Child Life / AD&D

Maximum Benefit 100% of Employee’s Benefit,

5x Annual Salary, up to $500,000 $10,000

Amount up to $250,000

Minimum Benefit Amount $10,000 $5,000 $10,000

Guarantee Issue 100% of Employee’s Benefit,

5x Annual Salary, up to $150,000 $10,000

Amount—New Hires up to $30,000

Guarantee Issue 100% of Employee’s Benefit,

5x Annual Salary, up to $150,000

Amount—2021 Open up to $30,000

Over Amount requires (EOI) Evidence of $10,000

Enrollment Insurability form Over Amount requires (EOI) Evidence of

Insurability form

Living Care Benefit /

80% of your Life Benefit can be obtained if diagnosed with a terminal illness.

Accelerated Death Benefit

If it is determined that you are totally disabled, your life insurance benefit will continue without

Waiver of Premium

payment of premium, subject to certain conditions.

Additional AD&D In addition to basic AD&D benefits, you are protected by the following benefits:

Benefits - Seat Belt - Child Education - Airbag - Common Carrier - Coma - Paralysis

The portability feature allows you to continue this insurance for yourself and your dependents

(if applicable) should your employment end, subject to the terms of eligibility defined in the

Portability

policy, without having to provide evidence of insurability (information about your health). This

feature requires the member to contact your plan administrator to complete forms.

23