Page 24 - Stamford Residence & Rehabilitation - Benefit Guide 3-1-2021

P. 24

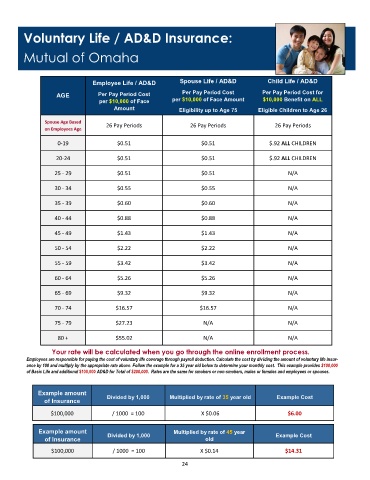

Voluntary Life / AD&D Insurance:

Mutual of Omaha

Employee Life / AD&D Spouse Life / AD&D Child Life / AD&D

AGE Per Pay Period Cost Per Pay Period Cost Per Pay Period Cost for

per $10,000 of Face per $10,000 of Face Amount $10,000 Benefit on ALL

Amount Eligibility up to Age 75 Eligible Children to Age 26

Spouse Age Based

26 Pay Periods 26 Pay Periods 26 Pay Periods

on Employees Age

0-19 $0.51 $0.51 $.92 ALL CHILDREN

20-24 $0.51 $0.51 $.92 ALL CHILDREN

25 - 29 $0.51 $0.51 N/A

30 - 34 $0.55 $0.55 N/A

35 - 39 $0.60 $0.60 N/A

40 - 44 $0.88 $0.88 N/A

45 - 49 $1.43 $1.43 N/A

50 - 54 $2.22 $2.22 N/A

55 - 59 $3.42 $3.42 N/A

60 - 64 $5.26 $5.26 N/A

65 - 69 $9.32 $9.32 N/A

70 - 74 $16.57 $16.57 N/A

75 - 79 $27.23 N/A N/A

80 + $55.02 N/A N/A

Your rate will be calculated when you go through the online enrollment process.

Employees are responsible for paying the cost of voluntary life coverage through payroll deduction. Calculate the cost by dividing the amount of voluntary life insur-

ance by 100 and multiply by the appropriate rate above. Follow the example for a 35 year old below to determine your monthly cost. This example provides $100,000

of Basic Life and additional $100,000 AD&D for Total of $200,000. Rates are the same for smokers or non-smokers, males or females and employees or spouses.

Example amount

Divided by 1,000 Multiplied by rate of 35 year old Example Cost

of Insurance

$100,000 / 1000 = 100 X $0.06 $6.00

Example amount Multiplied by rate of 45 year

Divided by 1,000 Example Cost

of Insurance old

$100,000 / 1000 = 100 X $0.14 $14.31

24