Page 25 - Improved +Example+Assessment+Report (LG Accrual) {FlipBook Test v1}_Neat (Online upload)

P. 25

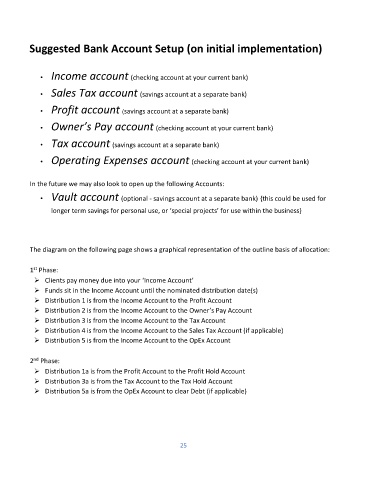

Suggested Bank Account Setup (on initial implementation)

• Income account (checking account at your current bank)

• Sales Tax account (savings account at a separate bank)

• Profit account (savings account at a separate bank)

• Owner’s Pay account (checking account at your current bank)

• Tax account (savings account at a separate bank)

• Operating Expenses account (checking account at your current bank)

In the future we may also look to open up the following Accounts:

• Vault account (optional - savings account at a separate bank) {this could be used for

longer term savings for personal use, or ‘special projects’ for use within the business}

The diagram on the following page shows a graphical representation of the outline basis of allocation:

st

1 Phase:

➢ Clients pay money due into your ‘Income Account’

➢ Funds sit in the Income Account until the nominated distribution date(s)

➢ Distribution 1 is from the Income Account to the Profit Account

➢ Distribution 2 is from the Income Account to the Owner’s Pay Account

➢ Distribution 3 is from the Income Account to the Tax Account

➢ Distribution 4 is from the Income Account to the Sales Tax Account (if applicable)

➢ Distribution 5 is from the Income Account to the OpEx Account

nd

2 Phase:

➢ Distribution 1a is from the Profit Account to the Profit Hold Account

➢ Distribution 3a is from the Tax Account to the Tax Hold Account

➢ Distribution 5a is from the OpEx Account to clear Debt (if applicable)

25