Page 21 - Improved +Example+Assessment+Report (LG Accrual) {FlipBook Test v1}_Neat (Online upload)

P. 21

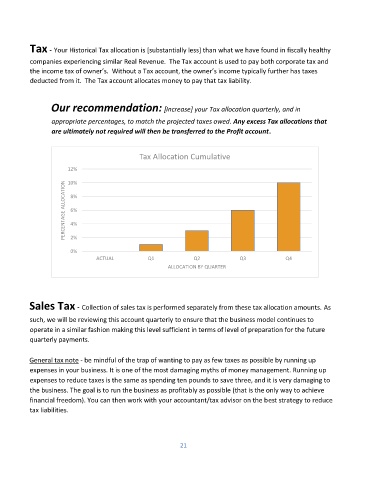

Tax - Your Historical Tax allocation is [substantially less] than what we have found in fiscally healthy

companies experiencing similar Real Revenue. The Tax account is used to pay both corporate tax and

the income tax of owner’s. Without a Tax account, the owner’s income typically further has taxes

deducted from it. The Tax account allocates money to pay that tax liability.

Our recommendation: [Increase] your Tax allocation quarterly, and in

appropriate percentages, to match the projected taxes owed. Any excess Tax allocations that

are ultimately not required will then be transferred to the Profit account.

Tax Allocation Cumulative

12%

10%

PERCENTAGE ALLOCATION 8%

6%

4%

2%

0%

ACTUAL Q1 Q2 Q3 Q4

ALLOCATION BY QUARTER

Sales Tax - Collection of sales tax is performed separately from these tax allocation amounts. As

such, we will be reviewing this account quarterly to ensure that the business model continues to

operate in a similar fashion making this level sufficient in terms of level of preparation for the future

quarterly payments.

General tax note - be mindful of the trap of wanting to pay as few taxes as possible by running up

expenses in your business. It is one of the most damaging myths of money management. Running up

expenses to reduce taxes is the same as spending ten pounds to save three, and it is very damaging to

the business. The goal is to run the business as profitably as possible (that is the only way to achieve

financial freedom). You can then work with your accountant/tax advisor on the best strategy to reduce

tax liabilities.

21