Page 3 - financial-literacy-pamphlets-sample

P. 3

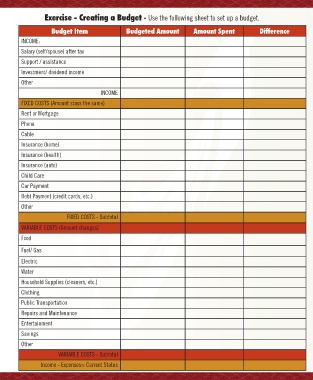

How to Create Your Clear Creating a Budget Exercise - Creating a Budget - Use the following sheet to set up a budget.

Financial Vision/Goals: 1. Gather together your bills, Budget Item Budgeted Amount Amount Spent Difference

1. Form a clear mental picture of what receipts, and statements INCOME:

you want when you get it - Go over your Salary (self/spouse) after tax

desires and be specific, “what do you 2. Record all of your sources of

want it to look like?” income. Support / assistance

2. Focus on your vision and 3. Create a list of monthly Investment/ dividend income

see it in a positive way expenses, breaking them into two categories: Other

–“I have enough money to fixed and variable. INCOME

pay off my student loans” 4. Fixed expenses are those that stay the same FIXED COSTS (Amount stays the same)

vs. “how am I ever going each month. These expenses for the most part are Rent or Mortgage

to pay off my student essential and not likely to change in the budget. Phone

loans?” You physically feel good thinking 5. Variable expenses are the type that will change

the positive way. The negative thoughts from month to month. Most adjustments are made Cable

make you feel afraid and worried. to variable expenses. Insurance (home)

3. Act now, mentally, as if you already 6. Total your monthly income and monthly Insurance (health)

have the things you are visualizing– See expenses. If your end result shows more income Insurance (auto)

beyond the present—have faith. than expenses, you can plan where the extra Child Care

4. Be thankful for what you desire as money should go. If your expenses are higher Car Payment

though you have already received it than your income, you will have to make cuts Debt Payment (credit cards, etc.)

now. somewhere in your budget. Other

7. Make adjustments to expenses. FIXED COSTS - Subtotal

Review Your Resources 8. Review your budget monthly. VARIABLE COSTS (Amount changes)

Food

Once you have a vision for your financial goals, take a look at your resources:

Fuel/ Gas

Time – When will you work on finances? How often? Do you have extra time on the weekends you could put

towards a part-time job? Are you spending your time watching TV when you could be working on your résumé Electric

to go after a higher paying job at work? Water

People – Look at the people who can help you move forward with your goals. How can you and your spouse Household Supplies (cleaners, etc.)

work together? Do you need to hire someone to help you do your taxes, or meet with an insurance agent to Clothing

identify future needs? Public Transportation

Money – Create your budget, then review it. Where can you cut back? What are the priorities? Are you using Repairs and Maintenance

your rewards credit card to its full advantage? Look at ways to save and invest your money. Entertainment

Materials – What do you need or have that will make you more efficient? Do you have a software package to do Savings

budgeting and bill paying, but you never find the time to update it? Do you need to have a garage sale to get Other

rid of things you never use? Put the money you make from the into your savings account. Could you save trips VARIABLE COSTS - Subtotal

to the library if you had a laptop? Income - Expenses= Current Status