Page 32 - financial-literacy-pamphlets-sample

P. 32

The Mortgage Application Process

Down Payment Equity

You can save much time and worry if you apply for

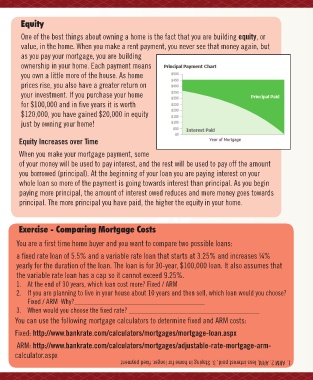

Are you ready to own a home? The biggest a mortgage before you even start house hunting. One of the best things about owning a home is the fact that you are building equity, or

challenge for many people is to save up With pre-approval, sellers may be willing to lower value, in the home. When you make a rent payment, you never see that money again, but

enough money for the initial down payment, the home price just to move the process along. You as you pay your mortgage, you are building

the money paid up front before you take out also know exactly how much you qualify for, and ownership in your home. Each payment means

a mortgage. Having 20% of the home price can shorten the time it takes to move into your new you own a little more of the house. As home

is recommended, but there are programs home. prices rise, you also have a greater return on

that allow you to purchase a home with your investment. If you purchase your home

3-5% down. You pay a non-refundable application fee of $200 to for $100,000 and in five years it is worth

$500 to complete a mortgage application. When you

If you put less than 20% down, many lender meet with the lender bring: $120,000, you have gained $20,000 in equity

just by owning your home!

will require you to have private mortgage

insurance (PMI). This protects the lender Proof of income: W-2 forms, recent pay stubs, Equity Increases over Time

against a loss if a borrower can’t pay the tax returns for the past two years, proof of any

loan. This is an extra cost that would be additional income. When you make your mortgage payment, some

included in your mortgage payment. Once Proof of your assets: List of bank account of your money will be used to pay interest, and the rest will be used to pay off the amount

you have 20% equity in your home, you can numbers, the address of your bank branch, you borrowed (principal). At the beginning of your loan you are paying interest on your

generally drop PMI. checking and savings account statements for the whole loan so more of the payment is going towards interest than principal. As you begin

paying more principal, the amount of interest owed reduces and more money goes towards

First-Time Home Buyers Incentives previous 2-3 months, list of investments and their principal. The more principal you have paid, the higher the equity in your home.

estimated values, titles of vehicles you own.

If a 20% down payment isn’t possible there

are government-assisted programs such Your debts: Credit card bills for the past few billing

as FHA (Federal Housing Administration), periods; Other outstanding debt, copies of rental Exercise - Comparing Mortgage Costs

VA (Veterans Administration), and Rural payments, alimony or child support. You are a first time home buyer and you want to compare two possible loans:

Development Services which can help you This approval process can take from one to several a fixed rate loan of 5.5% and a variable rate loan that starts at 3.25% and increases ¼%

find financing where the down payment weeks as the lender verifies your

requirements are lower. Visit www.hud.gov information, runs a credit check, and yearly for the duration of the loan. The loan is for 30-year, $100,000 loan. It also assumes that

the variable rate loan has a cap so it cannot exceed 9.25%.

for more information. determines if you are a good risk.

1. At the end of 30 years, which loan cost more? Fixed / ARM

Additional Costs 2. If you are planning to live in your house about 10 years and then sell, which loan would you choose?

Fixed / ARM Why?___________________________________

In general, you need to come up with enough money 3. When would you choose the fixed rate? ___________________________________

to cover three costs: earnest money, the deposit You can use the following mortgage calculators to determine fixed and ARM costs:

you make on the home when you submit your offer,

the down payment, and closing costs, the costs Fixed: http://www.bankrate.com/calculators/mortgages/mortgage-loan.aspx

associated with processing the paperwork to buy a ARM: http://www.bankrate.com/calculators/mortgages/adjustable-rate-mortgage-arm-

house. calculator.aspx 1. ARM 2. ARM, less interest paid, 3. Staying in home for longer. fixed payment