Page 200 - BCML AR 2019-20

P. 200

FINANCIAL STATEMENTS

Notes forming part of the Standalone Financial Statements

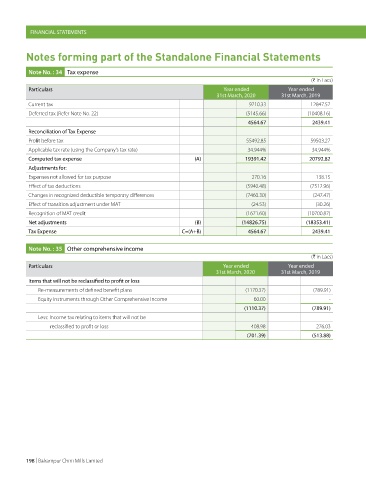

Note No. : 34 Tax expense

(H in Lacs)

Particulars Year ended Year ended

31st March, 2020 31st March, 2019

Current tax 9710.33 12847.57

Deferred tax [Refer Note No. 22] (5145.66) (10408.16)

4564.67 2439.41

Reconciliation of Tax Expense

Profit before tax 55492.85 59503.27

Applicable tax rate (using the Company’s tax rate) 34.944% 34.944%

Computed tax expense (A) 19391.42 20792.82

Adjustments for:

Expenses not allowed for tax purpose 270.16 138.15

Effect of tax deductions (5940.48) (7512.96)

Changes in recognized deductible temporary differences (7460.30) (247.47)

Effect of transition adjustment under MAT (24.53) (30.26)

Recognition of MAT credit (1671.60) (10700.87)

Net adjustments (B) (14826.75) (18353.41)

Tax Expense C=(A+B) 4564.67 2439.41

Note No. : 35 Other comprehensive income

(H in Lacs)

Particulars Year ended Year ended

31st March, 2020 31st March, 2019

Items that will not be reclassified to profit or loss

Re-measurements of defined benefit plans (1170.37) (789.91)

Equity Instruments through Other Comprehensive Income 60.00 -

(1110.37) (789.91)

Less: Income tax relating to items that will not be

reclassified to profit or loss 408.98 276.03

(701.39) (513.88)

198 | Balrampur Chini Mills Limited