Page 202 - BCML AR 2019-20

P. 202

FINANCIAL STATEMENTS

Notes forming part of the Standalone Financial Statements

Note No. : 36 Other disclosures (contd.)

2. Disclosures as required by Indian Accounting Standard (Ind AS) 37 Provisions, Contingent liabilities and Contingent assets :

(a) Provision for contingencies

(i) Provisions for contingencies represent provision towards various claims made/anticipated in respect of duties and taxes and

other claims against the Company based on the Management’s assessment.

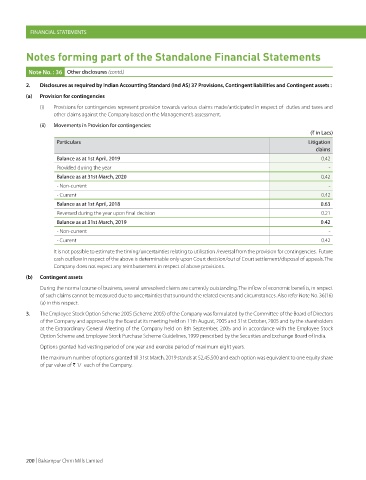

(ii) Movements in Provision for contingencies:

(H in Lacs)

Particulars Litigation

claims

Balance as at 1st April, 2019 0.42

Provided during the year -

Balance as at 31st March, 2020 0.42

- Non-current -

- Current 0.42

Balance as at 1st April, 2018 0.63

Reversed during the year upon final decision 0.21

Balance as at 31st March, 2019 0.42

- Non-current -

- Current 0.42

It is not possible to estimate the timing/uncertainties relating to utilisation /reversal from the provision for contingencies. Future

cash outflow in respect of the above is determinable only upon Court decision/out of Court settlement/disposal of appeals. The

Company does not expect any reimbursement in respect of above provisions.

(b) Contingent assets

During the normal course of business, several unresolved claims are currently outstanding. The inflow of economic benefits, in respect

of such claims cannot be measured due to uncertainties that surround the related events and circumstances. Also refer Note No. 36(16)

(a) in this respect.

3. The Employee Stock Option Scheme 2005 (Scheme 2005) of the Company was formulated by the Committee of the Board of Directors

of the Company and approved by the Board at its meeting held on 11th August, 2005 and 31st October, 2005 and by the shareholders

at the Extraordinary General Meeting of the Company held on 8th September, 2005 and in accordance with the Employee Stock

Option Scheme and Employee Stock Purchase Scheme Guidelines, 1999 prescribed by the Securities and Exchange Board of India.

Options granted had vesting period of one year and exercise period of maximum eight years.

The maximum number of options granted till 31st March, 2019 stands at 52,45,500 and each option was equivalent to one equity share

of par value of H 1/- each of the Company.

200 | Balrampur Chini Mills Limited