Page 207 - BCML AR 2019-20

P. 207

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Standalone Financial Statements

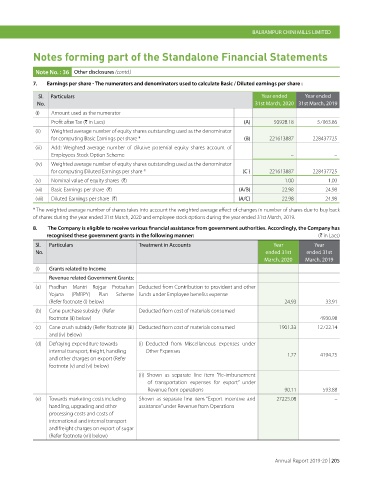

Note No. : 36 Other disclosures (contd.)

7. Earnings per share - The numerators and denominators used to calculate Basic / Diluted earnings per share :

Sl. Particulars Year ended Year ended

No. 31st March, 2020 31st March, 2019

(i) Amount used as the numerator

Profit after Tax (H in Lacs) (A) 50928.18 57063.86

(ii) Weighted average number of equity shares outstanding used as the denominator

for computing Basic Earnings per share * (B) 221613887 228437725

(iii) Add: Weighted average number of dilutive potential equity shares account of

Employees Stock Option Scheme – –

(iv) Weighted average number of equity shares outstanding used as the denominator

for computing Diluted Earnings per share * (C ) 221613887 228437725

(v) Nominal value of equity shares (H) 1.00 1.00

(vi) Basic Earnings per share (H) (A/B) 22.98 24.98

(vii) Diluted Earnings per share (H) (A/C) 22.98 24.98

* The weighted average number of shares takes into account the weighted average effect of changes in number of shares due to buy back

of shares during the year ended 31st March, 2020 and employee stock options during the year ended 31st March, 2019.

8. The Company is eligible to receive various financial assistance from government authorities. Accordingly, the Company has

recognised these government grants in the following manner: (H in Lacs)

Sl. Particulars Treatment in Accounts Year Year

No. ended 31st ended 31st

March, 2020 March, 2019

(i) Grants related to Income

Revenue related Government Grants:

(a) Pradhan Mantri Rojgar Protsahan Deducted from Contribution to provident and other

Yojana (PMRPY) Plan Scheme funds under Employee benefits expense

(Refer footnote (i) below) 24.93 33.91

(b) Cane purchase subsidy (Refer Deducted from cost of materials consumed

footnote (ii) below) – 4930.98

(c) Cane crush subsidy (Refer footnote (iii) Deducted from cost of materials consumed 1901.33 12722.14

and (iv) below)

(d) Defraying expenditure towards (i) Deducted from Miscellaneous expenses under

internal transport, freight, handling Other Expenses 1.77 4194.75

and other charges on export (Refer

footnote (v) and (vi) below)

(ii) Shown as separate line item “Re-imbursement

of transportation expenses for export” under

Revenue from operations 90.11 593.88

(e) Towards marketing costs including Shown as separate line item “Export incentive and 27225.08 –

handling, upgrading and other assistance” under Revenue from Operations

processing costs and costs of

international and internal transport

and freight charges on export of sugar

(Refer footnote (vii) below)

Annual Report 2019-20 | 205