Page 212 - BCML AR 2019-20

P. 212

FINANCIAL STATEMENTS

Notes forming part of the Standalone Financial Statements

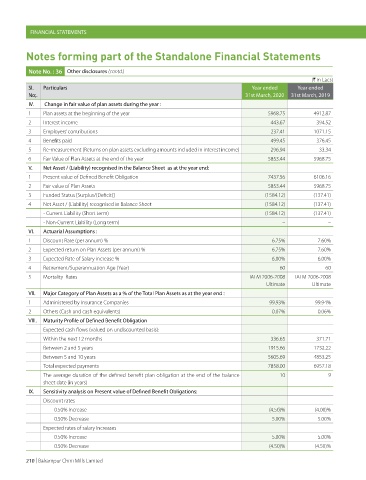

Note No. : 36 Other disclosures (contd.)

(H in Lacs)

Sl. Particulars Year ended Year ended

No;. 31st March, 2020 31st March, 2019

IV. Change in fair value of plan assets during the year :

1 Plan assets at the beginning of the year 5968.75 4912.87

2 Interest income 443.67 394.52

3 Employers’ contributions 237.41 1071.15

4 Benefits paid 499.45 376.45

5 Re-measurement (Returns on plan assets excluding amounts included in interest income) 296.94 33.34

6 Fair Value of Plan Assets at the end of the year 5853.44 5968.75

V. Net Asset / (Liability) recognised in the Balance Sheet as at the year end:

1 Present value of Defined Benefit Obligation 7437.56 6106.16

2 Fair value of Plan Assets 5853.44 5968.75

3 Funded Status [Surplus/(Deficit)] (1584.12) (137.41)

4 Net Asset / (Liability) recognised in Balance Sheet (1584.12) (137.41)

- Current Liability (Short term) (1584.12) (137.41)

- Non-Current Liability (Long term) – –

VI. Actuarial Assumptions :

1 Discount Rate (per annum) % 6.75% 7.60%

2 Expected return on Plan Assets (per annum) % 6.75% 7.60%

3 Expected Rate of Salary increase % 6.00% 6.00%

4 Retirement/Superannuation Age (Year) 60 60

5 Mortality Rates IALM 2006-2008 IALM 2006-2008

Ultimate Ultimate

VII. Major Category of Plan Assets as a % of the Total Plan Assets as at the year end :

1 Administered by Insurance Companies 99.93% 99.94%

2 Others (Cash and cash equivalents) 0.07% 0.06%

VIII. Maturity Profile of Defined Benefit Obligation

Expected cash flows (valued on undiscounted basis):

Within the next 12 months 336.65 371.71

Between 2 and 5 years 1915.66 1732.22

Between 5 and 10 years 5605.69 4853.25

Total expected payments 7858.00 6957.18

The average duration of the defined benefit plan obligation at the end of the balance 10 9

sheet date (in years)

IX. Sensitivity analysis on Present value of Defined Benefit Obligations:

Discount rates

0.50% Increase (4.50)% (4.00)%

0.50% Decrease 5.00% 5.00%

Expected rates of salary increases

0.50% Increase 5.00% 5.00%

0.50% Decrease (4.50)% (4.50)%

210 | Balrampur Chini Mills Limited