Page 213 - BCML AR 2019-20

P. 213

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Standalone Financial Statements

Note No. : 36 Other disclosures (contd.)

The sensitivity analysis above has been determined based on a method that extrapolates the impact on defined benefit obligation as a result

of reasonable changes in key assumptions occurring as at the balance sheet date.

All sensitivities are calculated using the same actuarial method as for the disclosed present value of the defined benefits obligation at year

end.

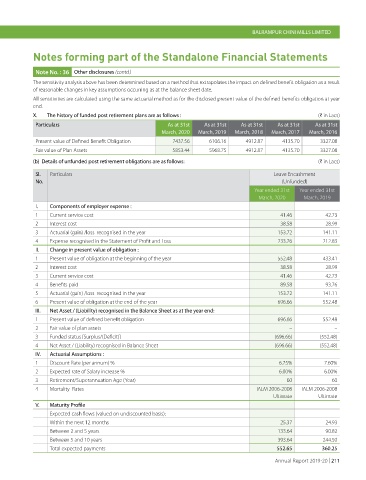

X. The history of funded post retirement plans are as follows : (H in Lacs)

Particulars As at 31st As at 31st As at 31st As at 31st As at 31st

March, 2020 March, 2019 March, 2018 March, 2017 March, 2016

Present value of Defined Benefit Obligation 7437.56 6106.16 4912.87 4135.70 3327.08

Fair value of Plan Assets 5853.44 5968.75 4912.87 4135.70 3327.08

(b) Details of unfunded post retirement obligations are as follows: (H in Lacs)

Sl. Particulars Leave Encashment

No. (Unfunded)

Year ended 31st Year ended 31st

March, 2020 March, 2019

I. Components of employer expense :

1 Current service cost 41.46 42.73

2 Interest cost 38.58 28.99

3 Actuarial (gain) /loss recognised in the year 153.72 141.11

4 Expense recognised in the Statement of Profit and Loss 233.76 212.83

II. Change in present value of obligation :

1 Present value of obligation at the beginning of the year 552.48 433.41

2 Interest cost 38.58 28.99

3 Current service cost 41.46 42.73

4 Benefits paid 89.58 93.76

5 Actuarial (gain) /loss recognised in the year 153.72 141.11

6 Present value of obligation at the end of the year 696.66 552.48

III. Net Asset / (Liability) recognised in the Balance Sheet as at the year end:

1 Present value of defined benefit obligation 696.66 552.48

2 Fair value of plan assets – –

3 Funded status [Surplus/(Deficit)] (696.66) (552.48)

4 Net Asset / (Liability) recognised in Balance Sheet (696.66) (552.48)

IV. Actuarial Assumptions :

1 Discount Rate (per annum) % 6.75% 7.60%

2 Expected rate of Salary increase % 6.00% 6.00%

3 Retirement/Superannuation Age (Year) 60 60

4 Mortality Rates IALM 2006-2008 IALM 2006-2008

Ultimate Ultimate

V. Maturity Profile

Expected cash flows (valued on undiscounted basis):

Within the next 12 months 25.37 24.93

Between 2 and 5 years 133.64 90.82

Between 5 and 10 years 393.64 244.50

Total expected payments 552.65 360.25

Annual Report 2019-20 | 211