Page 218 - BCML AR 2019-20

P. 218

FINANCIAL STATEMENTS

Notes forming part of the Standalone Financial Statements

Note No. : 36 Other disclosures (contd.)

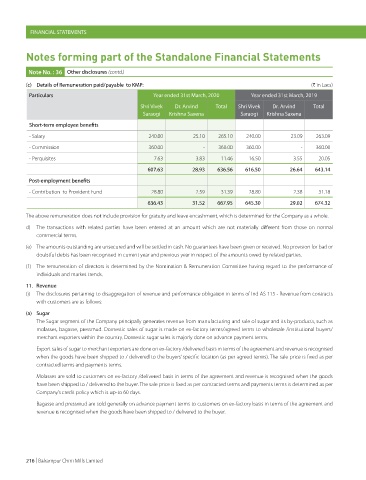

(c) Details of Remuneration paid/payable to KMP: (H in Lacs)

Particulars Year ended 31st March, 2020 Year ended 31st March, 2019

Shri Vivek Dr. Arvind Total Shri Vivek Dr. Arvind Total

Saraogi Krishna Saxena Saraogi Krishna Saxena

Short-term employee benefits

- Salary 240.00 25.10 265.10 240.00 23.09 263.09

- Commission 360.00 - 360.00 360.00 - 360.00

- Perquisites 7.63 3.83 11.46 16.50 3.55 20.05

607.63 28.93 636.56 616.50 26.64 643.14

Post-employment benefits

- Contribution to Provident Fund 28.80 2.59 31.39 28.80 2.38 31.18

636.43 31.52 667.95 645.30 29.02 674.32

The above remuneration does not include provision for gratuity and leave encashment, which is determined for the Company as a whole.

d) The transactions with related parties have been entered at an amount which are not materially different from those on normal

commercial terms.

(e) The amounts outstanding are unsecured and will be settled in cash. No guarantees have been given or received. No provision for bad or

doubtful debts has been recognised in current year and previous year in respect of the amounts owed by related parties.

(f) The remuneration of directors is determined by the Nomination & Remuneration Committee having regard to the performance of

individuals and market trends.

11. Revenue

(i) The disclosures pertaining to disaggregation of revenue and performance obligation in terms of Ind AS 115 - Revenue from contracts

with customers are as follows:

(a) Sugar

The Sugar segment of the Company principally generates revenue from manufacturing and sale of sugar and its by-products, such as

molasses, bagasse, pressmud. Domestic sales of sugar is made on ex-factory terms/agreed terms to wholesale /institutional buyers/

merchant exporters within the country. Domestic sugar sales is majorly done on advance payment terms.

Export sales of sugar to merchant exporters are done on ex-factory /delivered basis in terms of the agreement and revenue is recognised

when the goods have been shipped to / delivered to the buyers’ specific location (as per agreed terms). The sale price is fixed as per

contracted terms and payments terms.

Molasses are sold to customers on ex-factory /delivered basis in terms of the agreement and revenue is recognised when the goods

have been shipped to / delivered to the buyer. The sale price is fixed as per contracted terms and payments terms is determined as per

Company’s credit policy which is up-to 60 days.

Bagasse and pressmud are sold generally on advance payment terms to customers on ex-factory basis in terms of the agreement and

revenue is recognised when the goods have been shipped to / delivered to the buyer.

216 | Balrampur Chini Mills Limited