Page 211 - BCML AR 2019-20

P. 211

BALRAMPUR CHINI MILLS LIMITED

Notes forming part of the Standalone Financial Statements

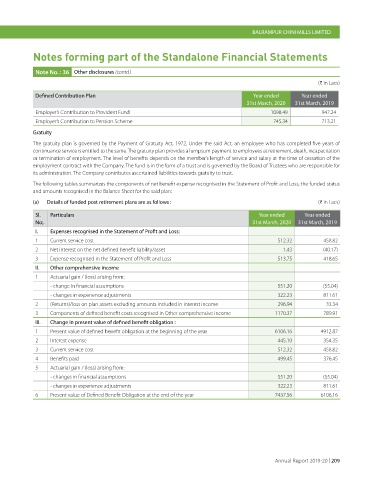

Note No. : 36 Other disclosures (contd.)

(H in Lacs)

Defined Contribution Plan Year ended Year ended

31st March, 2020 31st March, 2019

Employer’s Contribution to Provident Fund 1098.49 947.24

Employer’s Contribution to Pension Scheme 745.34 713.21

Gratuity

The gratuity plan is governed by the Payment of Gratuity Act, 1972. Under the said Act, an employee who has completed five years of

continuance service is entitled to the same. The gratuity plan provides a lumpsum payment to employees at retirement, death, incapacitation

or termination of employment. The level of benefits depends on the member’s length of service and salary at the time of cessation of the

employment contract with the Company. The fund is in the form of a trust and is governed by the Board of Trustees who are responsible for

its administration. The Company contributes ascertained liabilities towards gratuity to trust.

The following tables summarizes the components of net benefit expense recognised in the Statement of Profit and Loss, the funded status

and amounts recognised in the Balance Sheet for the said plan:

(a) Details of funded post retirement plans are as follows : (H in Lacs)

Sl. Particulars Year ended Year ended

No;. 31st March, 2020 31st March, 2019

I. Expenses recognised in the Statement of Profit and Loss:

1 Current service cost 512.32 458.82

2 Net interest on the net defined benefit liability/asset 1.43 (40.17)

3 Expense recognised in the Statement of Profit and Loss 513.75 418.65

II. Other comprehensive income

1 Actuarial gain / (loss) arising from:

- change in financial assumptions 551.20 (55.04)

- changes in experience adjustments 322.23 811.61

2 (Returns)/loss on plan assets excluding amounts included in interest income 296.94 33.34

3 Components of defined benefit costs recognised in Other comprehensive income 1170.37 789.91

III. Change in present value of defined benefit obligation :

1 Present value of defined benefit obligation at the beginning of the year 6106.16 4912.87

2 Interest expense 445.10 354.35

3 Current service cost 512.32 458.82

4 Benefits paid 499.45 376.45

5 Actuarial gain / (loss) arising from:

- changes in financial assumptions 551.20 (55.04)

- changes in experience adjustments 322.23 811.61

6 Present value of Defined Benefit Obligation at the end of the year 7437.56 6106.16

Annual Report 2019-20 | 209