Page 21 - 80819_NSAA_Volume26_Journal_Neat

P. 21

in lodges, or adding chairlift surveillance systems, may now states), including California, New York, Massachusetts,

be immediately expensed under Section 179. And adding Connecticut, New Jersey, Oregon, Minnesota, and

furnishings for lodging—like beds, refrigerators, or other Vermont. The new tax bill caps the amount of SALT taxes

upgrades—still remain eligible for Section 179 expensing. that individuals and married couples can deduct from their

Furthermore, it also appears that the expansion of federal taxes at $10,000.

Section 179 property for expensing will extend to spe- While individual filers and families will have a cap of

cialty piping systems. This could be a hugely critical incen- $10,000 on SALT tax deductions, corporations in these

tive for ski areas looking to upgrade or replace their aging high-tax states will, in fact, still be able to deduct their SALT

snowmaking pipe networks. And there is more good news: taxes as a business expense. Pass-through entities in these

Unlike bonus depreciation rules, Section 179 expensing high-tax states—like LLCs, S Corps, partnerships, and sole

applies for both federal and state taxes. Also, bear in mind proprietorships—however, will not be able to deduct their

the bonus depreciation rules eventually expire after 2022, SALT taxes.

and phase out until 2027—but the expansion of Section For most moderate-income people (e.g., most of our ski

179 expensing is a permanent, and extremely beneficial, area employees), the elimination of SALT deductions likely

change to the tax code for ski areas. won’t matter because both the tax law doubles the standard

Because these definitions of expanded property deduction, from $6,350 to $12,000 for individuals and

under Section 179 will require specific guidance from the from $12,700 to $24,000 for couples. As a result, far fewer

IRS, check with your CPA on how Section 179 impacts individuals will itemize their federal taxes; more wealthy

improvements you may be considering. filers in high-tax blue states, however, may see a federal tax

increase given that they can only deduct a maximum of

Losers: Ski States with High Taxes $10,000 of their state and local taxes from the federal taxes.

One of the most contentious aspects of the new tax leg- For ski areas in such states operating as pass-through

islation is how Congress dramatically limited the ability entities, leveraging bonus depreciation and Section 179

of individuals to deduct their state, local, sales, and prop- expensing—while adding important capital improve-

erty taxes (called “SALT” taxes) from their federal tax- ments—will also potentially provide the tax shelters and

able income. The ability to deduct SALT taxes is especially net operating losses necessary to shield the loss of these

important for taxpayers in high tax states (and many ski SALT deductions.

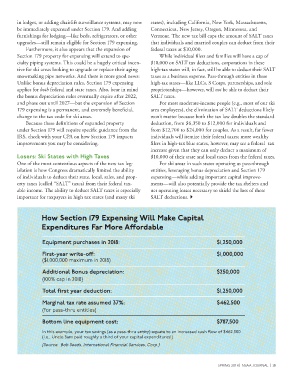

How Section 179 Expensing Will Make Capital

Expenditures Far More Aordable

Equipment purchases in 2018: $1,250,000

First-year write-o: $1,000,000

($1,000,000 maximum in 2018)

Additional Bonus depreciation: $250,000

(100% cap in 2018)

Total first year deduction: $1,250,000

Marginal tax rate assumed 37%: $462,500

(for pass-thru entities)

Bo

om line equipment cost: $787,500

In this example, your tax savings (as a pass-thru entity) equate to an increased cash flow of $462,500

(i.e., Uncle Sam paid roughly a third of your capital expenditures!)

(Source: Bob Seeds, International Financial Services, Corp.)

SPRING 2018 | NSAA JOURNAL | 19