Page 64 - 31030 eBook Part107 FIN

P. 64

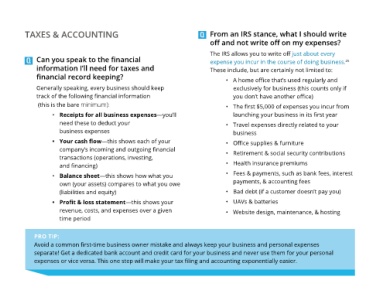

TAXES & ACCOUNTING Q From an IRS stance, what I should write

off and not write off on my expenses?

The IRS allows you to write off just about every

Q Can you speak to the financial expense you incur in the course of doing business.

25

information I’ll need for taxes and These include, but are certainly not limited to:

financial record keeping? • A home office that’s used regularly and

Generally speaking, every business should keep exclusively for business (this counts only if

track of the following financial information you don’t have another office)

(this is the bare minimum): • The first $5,000 of expenses you incur from

• Receipts for all business expenses—you’ll launching your business in its first year

need these to deduct your • Travel expenses directly related to your

business expenses business

• Your cash flow—this shows each of your • Office supplies & furniture

company’s incoming and outgoing financial • Retirement & social security contributions

transactions (operations, investing,

and financing) • Health insurance premiums

• Balance sheet—this shows how what you • Fees & payments, such as bank fees, interest

own (your assets) compares to what you owe payments, & accounting fees

(liabilities and equity) • Bad debt (if a customer doesn’t pay you)

• Profit & loss statement—this shows your • UAVs & batteries

revenue, costs, and expenses over a given • Website design, maintenance, & hosting

time period

PRO TIP:

Avoid a common first-time business owner mistake and always keep your business and personal expenses

separate! Get a dedicated bank account and credit card for your business and never use them for your personal

expenses or vice versa. This one step will make your tax filing and accounting exponentially easier.