Page 123 - AR DPBM-2016--SMALL

P. 123

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

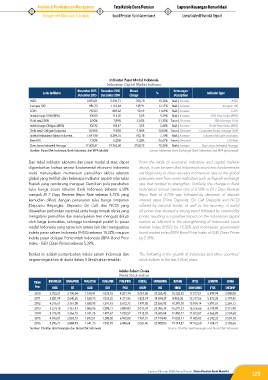

Indikator Pasar Modal Indonesia

Indonesian Capital Market Indicator

Desember 2015 Desember 2016 Mutasi Keterangan

Jenis Indikator % Indicator Type

December 2015 December 2016 Change Description

IHSG 4.593,01 5.296,71 703,70 15,32% Naik | Increase IHSG

Kompas 100 986,73 1116,64 129,91 13,17% Naik | Increase Kompas 100

LQ45 792,03 884,62 92,59 11,69% Naik | Increase LQ45

Indeks harga SUN (IBPA) 108,50 114,35 5,85 5,39% Naik | Increase SUN Price Index (IBPA)

Yield rata2 SBN 8,90% 7,89% -1,01% -11,35% Turun | Decrease SBN Average Yield

Indeks harga Obligasi (IBPA) 102,92 105,47 2,55 2,48% Naik | Increase Bond Price Index (IBPA)

Yield rata2 Obligasi Korporasi 10,56% 9,50% -1,06% -10,04% Turun | Decrease Corporate Bonds Average Yield

Indeks Reksadana Saham Infovesta 7.691,98 8.284,16 592,18 7,70% Naik | Increase Infovesta Mutual Fund Index

Rate LPS 7,50% 6,25% -1,25% -16,67% Turun | Decrease LPS Rate

Dow Jones Industrial Average 17.603,87 19.762,60 2158,73 12,26% Naik | Increase Dow Jones Industrial Average

Sumber: Bursa Efek Indonesia, Bank Indonesia, dan IBPA (diolah) Source: Indonesia Stock Exchange, Bank Indonesia, and IBPA (processed)

Dari tabel indikator ekonomi dan pasar modal di atas, dapat From the table of economic indicators and capital markets

digambarkan bahwa secara fundamental ekonomi Indonesia above, it can be seen that Indonesia’s economic fundamentals

mulai menunjukkan momentum pemulihan akibat tekanan are beginning to show recovery momentum due to the global

global yang terlihat dari beberapa indikator seperti nilai tukar pressures seen from some indicators such as Rupiah exchange

Rupiah yang cenderung menguat. Demikian pula perubahan rate that tended to strengthen. Similarly, the change in Bank

suku bunga acuan tahunan Bank Indonesia sebesar 6,50% Indonesia’s annual interest rate of 6.50% to BI 7 Days Reverse

menjadi BI 7 Days Reverse Repo Rate sebesar 4,75% yang Repo Rate of 4.75% was followed by decrease of deposit

kemudian diikuti dengan penurunan suku bunga simpanan interest rates (Time Deposits, On Call Deposits and NCD)

(Deposito Berjangka, Deposito On Call, dan NCD) yang offered by national banks; as well as the recovery of world

ditawarkan perbankan nasional; serta harga minyak dunia yang oil prices that showed a strong trend followed by commodity

mengalami pemulihan dan menunjukkan tren menguat diikuti prices, resulting in a positive impact on the Indonesian capital

oleh harga komoditas, sehingga berdampak positif ke pasar market as reflected in the strengthening of Indonesia’s stock

modal Indonesia yang tercermin antara lain dari menguatnya market index (IHSG) by 15.32% and Indonesian government

indeks pasar saham Indonesia (IHSG) sebesar 15,32% maupun bond market index (IBPA Bond Price Index of IGBI Clean Prices

indeks pasar obligasi Pemerintah Indonesia (IBPA Bond Price by 5.39%.

Index - IGBI Clean Prices) sebesar 5,39%.

Berikut ini adalah pertumbuhan indeks saham Indonesia dan The following is the growth of Indonesia and other countries’

negara-negara lain di dunia dalam 5 (lima) tahun terakhir: stock indices in the last 5 (five) years:

Indeks Saham Dunia

World Stock Indices

Tahun INDONESIA SINAGPORE MALAYSIA THAILAND PHILIPINA KORSEL HONGKONG JEPANG NYSE LONDON CHINA

Year IHSG STI KLSE SETI PSEI KOSPI HIS NIKEI DOW JONES FTSE SHCOMP

2010 3.703,51 3.190,04 1.518,91 1.032,76 4.201,14 2.051,00 23.035,45 10.228,92 11.577,51 5.899,94 2.808,08

2011 3.821,99 2.645,35 1.530,73 1.025,32 4.371,96 1.825,74 18.434,39 8.455,35 12.217,56 5.572,28 2.199,42

2012 4.316,67 3.167,08 1.688,95 1.391,93 5.812,73 1.997,05 22.656,92 10.395,18 13.104,14 5.897,81 2.269,13

2013 4.274,18 3.167,43 1.866,96 1.298,71 5.889,83 2.011,34 23.306,39 16.291,31 16.576,66 6.749,09 2.115,98

2014 5.226,95 3.366,15 1.761,25 1.497,67 7.230,57 1.915,59 23.605,04 17.450,77 17.823,07 6.566,09 3.234,68

2015 4.593,01 2.882,73 1.692,51 1.288,02 6.952,08 1.961,31 21.914,40 19.033,71 17.425,03 6.242,32 3.539,18

2016 5.296,71 2.884,93 1.641,73 1.542,93 6.840,64 2.026,46 22.000,56 19.114,37 19.762,60 7.104,71 3.103,64

Sumber: Otoritas Jasa Keuangan dan Bursa Efek Indonesia Source: Otoritas Jasa Keuangan and Bursa Efek Indonesia

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

123