Page 491 - AR DPBM-2016--SMALL

P. 491

Analisis & Pembahasan Manajemen Tata Kelola Dana Pensiun Laporan Keuangan Konsolidasi

Management Discussion & Analysis Good Pension Fund Governance Consolidated Financial Report

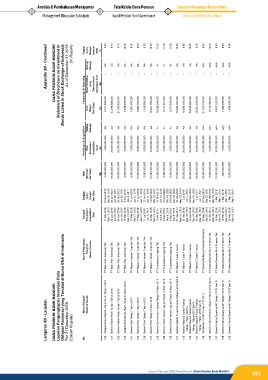

Appendix XII - Continued DANA PENSIUN BANK MANDIRI Statement of Disclosure on Investment In Bonds Listed in Stock Exchange of Indonesia As of December 31, 2016 (In Rupiah) Tingkat Pelaporan/ At Reporting Suku Rating/ Nilai Perolehan Bunga/ Bunga/ Ratings yang Interest Diamortisasi/ Rate Amortized Cost % Rp 9.40 AA- -- 9.15 AA -- 9.15 AA -- 10.50 AA- -- 8.00 AA- -- 8.00 AA- -- 8.00 AA- -- 10.00 AA- -- 11.

Perolehan/ At Acquisition Nilai Rating/ Nilai Wajar/ Ratings Perolehan/ Fair Value Acquisition Cost Rp Rp 2,014,048,000 AA- 1,925,000,000 24,399,925,000 AA 25,000,000,000 24,399,925,000 AA 25,000,000,000 2,038,468,000 AA- 2,009,000,000 7,864,560,000 AA- 7,508,000,000 9,830,700,000 AA- 9,385,000,000 4,915,350,000 AA- 5,000,000,000 10,044,750,000 AA 10,000,000,000 10,296,340,000 A+ 10,000,000

Nilai Nominal/ Par Value Rp 2,000,000,000 25,000,000,000 25,000,000,000 2,000,000,000 8,000,000,000 10,000,000,000 5,000,000,000 10,000,000,000 10,000,000,000 9,000,000,000 5,000,000,000 10,000,000,000 20,000,000,000 20,000,000,000 18,000,000,000 25,000,000,000 5,000,000,000 10,000,000,000 1,500,000,000 5,000,000,000

Tanggal Jatuh Tempo/ Due Date 20 Des 2019/ Dec 20, 2019 28 Jun 2021/ Jun 28, 2021 28 Jun 2021/ Jun 28, 2021 9 Nov 2017/ Nov 9, 2017 11 Jun 2018/ Jun 11, 2018 11 Jun 2018/ Jun 11, 2018 11 Jun 2018/ Jun 11, 2018 18 Mar 2020/ Mar 18, 2020 10 Okt 2019/ Oct 10, 2019 16 Des 2020/ Dec 16, 2020 26 Des 2020/ Dec 16, 2020 23 Mei 2018/ May 23, 2018 1 Jun 2019/ Jun 1, 2019 18 Des 2020/ Dec 18, 2020 1 Jun 2021/ Ju

Tanggal Perolehan/ AcquisitIon Date 11 Feb 2015/ Feb 11, 2015 24 Jun 2016/ Jun 24, 2016 24 Jun 2016/ Jun 24, 2016 10 Feb 2015/ Feb 10, 2015 17 Feb 2015/ Feb 17, 2015 17 Feb 2015/ Feb 17, 2015 5 Jun 2013/ Jun 5, 2013 12 Mar 2015/ Mar 12, 2015 8 Okt 2014/ Oct 8, 2014 8 Des 2015/ Dec 8, 2015 8 Des 2015/ Dec 8, 2015 21 Mei 2014/ May 21, 2014 30 Mei 2016/ May 30, 2016 14 Des 2015/ Dec 14, 2015 30 Mei 2016/

Nama Perusahaan Penerbit/ Name of Issuer PT Bank Pan Indonesia Tbk PT Bank Pan Indonesia Tbk PT Bank Pan Indonesia Tbk PT Bank Pan Indonesia Tbk PT Nippon Indosari Corpindo Tbk PT Nippon Indosari Corpindo Tbk PT Nippon Indosari Corpindo Tbk PT Nippon Indosari Corpindo Tbk PT Summarecon Agung Tbk PT Summarecon Agung Tbk PT Summarecon Agung Tbk PT Mandiri Tunas Finance PT Mandiri Tunas Finance PT Mandiri Tunas Finance

Lampiran XII - Lanjutan DANA PENSIUN BANK MANDIRI Laporan Pengungkapan Investasi Pada Obligasi Korporasi yang Tercatat di Bursa Efek di Indonesia Per 31 Desember 2016 (Dalam Rupiah) Nama Obligasi/ Name of Bonds Obligasi Subor Berkel I Bank Panin Tahap I 2012 Berkel II Bank Panin Tahap I Tahun 2016 Berkel II Bank Panin Tahap I Tahun 2016 Obligasi Subordinasi Bank Panin III Tahun 2010 Berkel I Rpti Tahap I Tahun 2013 Berkel I Roti Tahap I

No. 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139

Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri

491